Automated trading is fast becoming the new normal in the global fixed income markets. Once considered too complex and nuanced for automation compared with asset classes such as equities and FX, bonds are now experiencing their very own automation revolution.

Machines have been on the rise in fixed income for a number of years, with nearly 60% of European government bonds and around 50% of US Treasuries now traded electronically. Even corporate bonds are picking up pace in the electronification race, with 25% of global trading volume in investment-grade bonds now executed on electronic trading platforms.

Against this backdrop, the emergence of new technologies such as machine learning and advanced APIs is now enabling bond traders to take automated electronic trading to the next level and transform their traditionally labour-intensive workflow into a low-touch or even no-touch process.

Automation is also a crucial step in lessening the burden of new regulatory requirements. Since January, MiFID II has required European market participants to report the prices and volumes of all completed bond transactions – an unprecedented level of detail which has huge time, cost and resourcing implications without the use of automated technology.

Many believe that MiFID II will also lead to more algorithmic trading in fixed income. The need for an institution to demonstrate that it is achieving best execution to regulators means it needs a more thorough audit trail, and algorithmic trading naturally provides this.

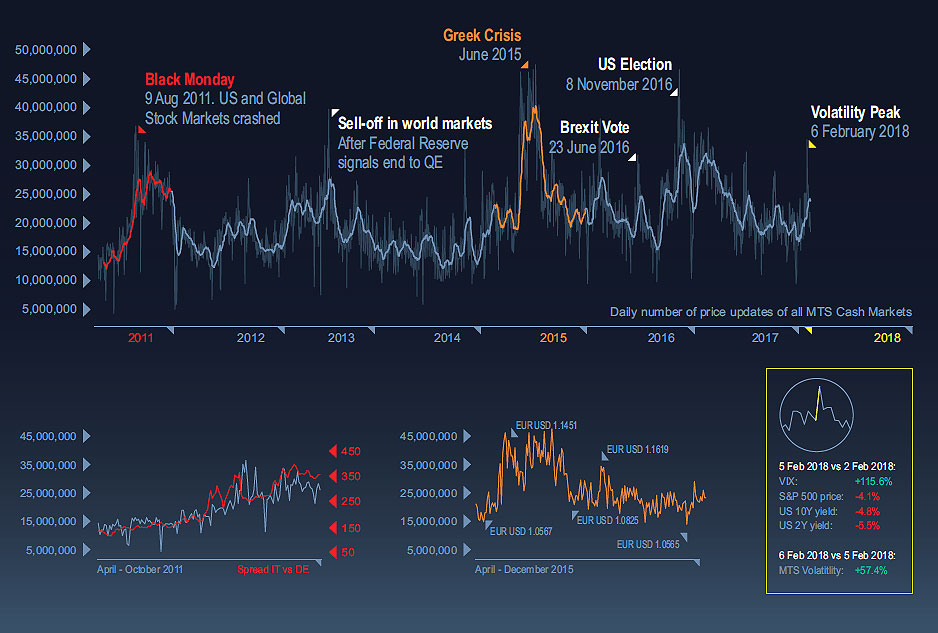

However, the success of automated trading technology and algorithms relies entirely on the availability of high quality and comprehensive market data – both historical and real-time. Feeding APIs and innovative new automation tools with inaccurate or incomplete data is inherently risky. Put simply, bad data in equals bad data out.

This data needs to be available for a substantive date range and be thoroughly cleaned if it is to facilitate the building and testing of algorithms to be used to feed automated trading features on electronic platforms. This is even more crucial in volatile markets, when historical data from previous market events is critical for back-testing algorithmic trading models.

As a facilitator of leading electronic fixed income markets in Europe and the US, we recognise our role at the forefront of technological evolution in this space. We have developed a range of innovative automated trading functionalities across our platforms, backed by the richest and most comprehensive market data available.

Our data provides actual traded prices or executable prices – never indicative – that are live on our platforms and at which MTS participants may deal. It is sourced from a trading community of over 500 unique counterparties and average daily turnover exceeding EUR 100 billion.

The majority of the electronic Euro-denominated government bond market volume has been traded on our markets for over 30 years, therefore our data can be regarded as a highly accurate representation of trading data in these markets.

This data is crucial to the functionality and features we offer on our dealer-to-client and interdealer European government bond marketplaces, our repo platform and our all-to-all order book for corporate bonds and emerging market debt.

Dealer-to-client government bond and credit trading

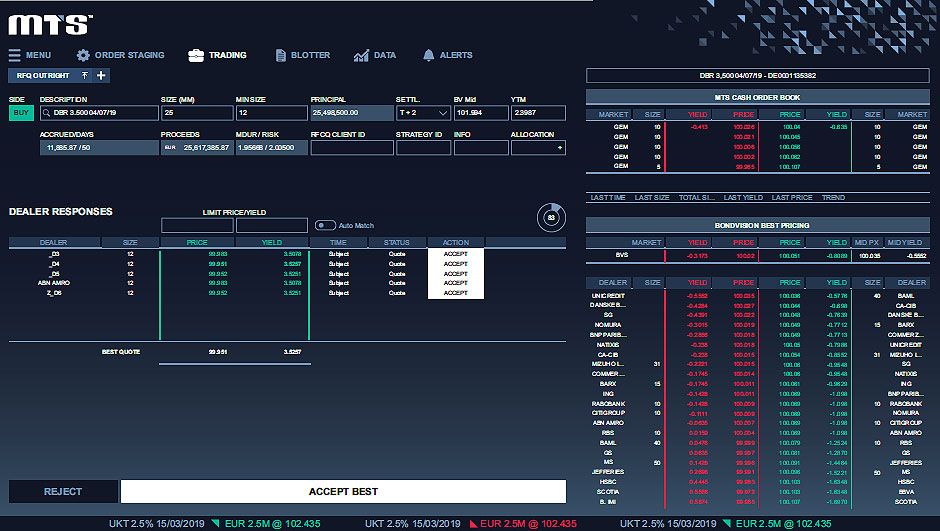

On our MTS BondVision multi-dealer-to-client platform, an automatic rules engine transforms orders staged from a trader’s OMS into RFQs and executes the trade without the need for user intervention. Criteria can be set based on quantities, asset type and counterparty type, giving traders a maximum level of control whilst allowing them to reap the efficiency benefits of automation.

We have also completely redesigned BondVision’s GUI around the presentation of market data, ensuring data is displayed in a graphical, intuitive and user-friendly manner on the screen. The new GUI helps to automate a trader’s workflow, supporting low-touch and no-touch trading strategies.

In addition, our data powers MTS BondVision’s pre-trade information tool which enables asset managers to search for the bonds they wish to trade and identify an appropriate counterparty in an efficient and effective manner. This significantly increases the probability of a successful trade and improves the efficiency of the execution workflow process.

Interdealer European government bond trading

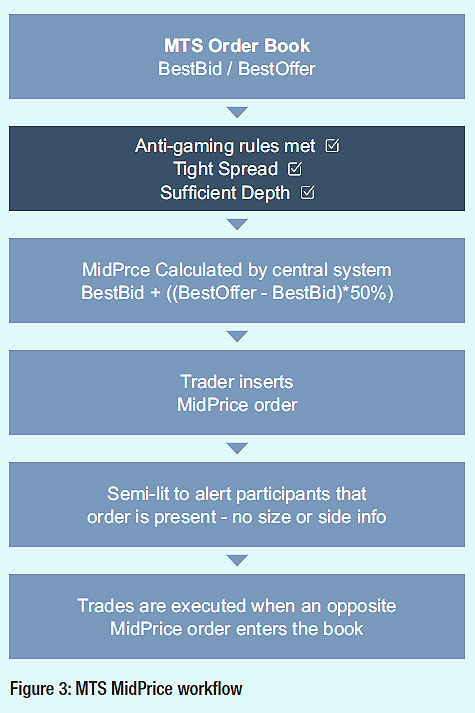

Our MTS Cash platform supports the interdealer European government bond marketplace and offers the automated MidPrice functionality which offers an orderly method of price discovery, based on real executable market rates. It allows traders to view a continuous and dynamic mid-price order book and work large orders efficiently without moving the market.

Repo trading

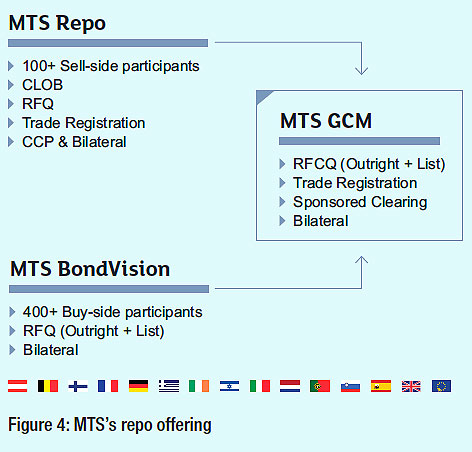

In the repo market, our MTS Repo platform is over 20 years old and offers historical data covering this period. More recently we launched the Global Collateral Management (GCM) service, which combines the functionality, technology and networks of our established dealer-to-dealer MTS Repo and MTS BondVision platforms to create a dedicated new section on MTS BondVision, enabling direct electronic dealer-to-client trading in repo contracts.

By adding RFQ trading functionality to our existing repo technology, we enable sell-side dealers to trade with buy-side clients using familiar protocols, existing connectivity and automated straight through processing (STP), requiring limited, or no development work on both sides. Again, this innovative automated functionality is fuelled by comprehensive and executable market data. The platform also offers fully automated connectivity to LCH’s recently launched Sponsored Clearing Service.

Corporate bonds and emerging market debt

Data is also crucial to our offering in the corporate bond and emerging market debt spaces, where our MTS BondsPro platform offers US and UK traders an innovative all-to-all model that boosts liquidity by enabling anyone to act as either price provider or price taker.

Pre-trade data on the platform is derived from over 650 buy-side and sell- side market participants and is distributed in real-time. Users see the full depth of market before they execute a trade, which is a key differentiator for our platform. Market participants can access limit order book prices on over 15,000 USD-denominated and non-US denominated corporate and financial bonds every day.

MTS Data | +44 (0)20 7797 4090

data@mtsmarkets.com

©Markets Media Europe 2025