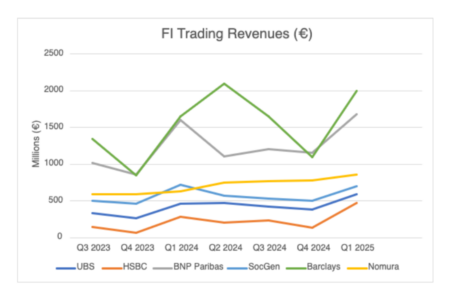

Fixed income trading revenues spiked in the first three months of the year at Barclays, putting the bank significantly ahead of the majority with a reported €2 billion.

Despite the 82% quarter-on-quarter (QoQ) and 21% year-on-year (YoY) increases, net Q1 results were still 4% below Q2 2024’s record results of €2.1 billion. Volatility in the bank’s results are out of sync with those seen in the majority of its European peers.

Success this quarter was driven by strong activity in rates, FX and securitised products, the bank stated.

Director, Angela Cross, commented: “A strong performance across the board reflects our investment in the business, both in intermediation and in financing.”

A close runner up was BNP Paribas, which saw fixed income trading revenues rise by 4% YoY to €1.7 billion in the first three months of the year. This also marked a 46% QoQ increase for the bank, and its strongest performance by this metric in recent years.

Lars Machenil, chief financial officer, elaborated: “FICC was driven by macro, particularly foreign exchange. Rates benefited from modest growth and credit was down as a primary activity did not offset weaker credit trading flows.”

Elsewhere, Nomura, Societe Generale, UBS and HSBC began converging in the first three months of the year. Results from UBS and Societe Generale have followed similar patterns since Q2 2024, UBS edging ahead this quarter with €589 million (up 55% QoQ) and SocGen reporting €698 million (up 40% QoQ).

HSBC saw an even sharper spike in revenues, despite remaining at the bottom of the pack. Fixed income trading revenue was €468 million, up 240% QoQ and 63% YoY.

Nomura, while remaining ahead of this trio, took a narrower lead than recent quarters. The difference between its results and those of next-in-line Societe Generale narrowed by €123 million between Q4 2024 and Q1 2025 – a contraction of 43%.

©Markets Media Europe 2025