BNP Paribas was the success story in Q2 2025 fixed income trading, reporting €1.4 billion in revenues. Despite reporting a 16% decline in revenues quarter-on-quarter (QoQ), the bank saw a 28% increase year-on-year (YoY), the greatest bump of its cohort.

During an earnings call, group chief financial officer Lars Machenil recognised the bank’s strength in the sector and was optimistic about H2.

“Our pipeline within global banking is strong for the remainder of the year. Global markets revenues were driven by a very strong performance of FICC when compared in particular to our US peers. FICC was indeed strong in all regions, particularly driven by FX, but also credit.”

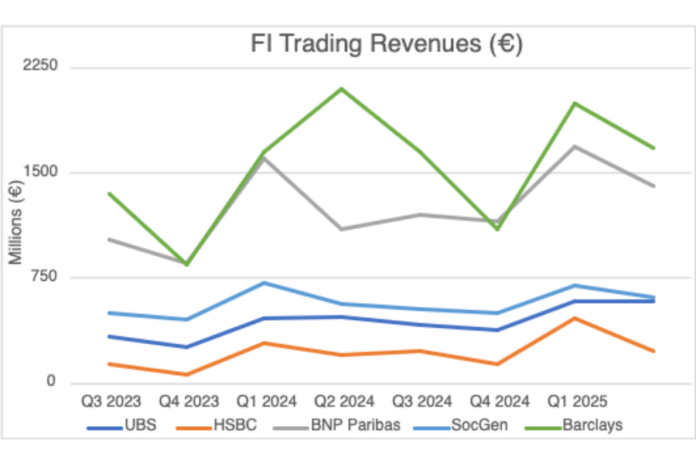

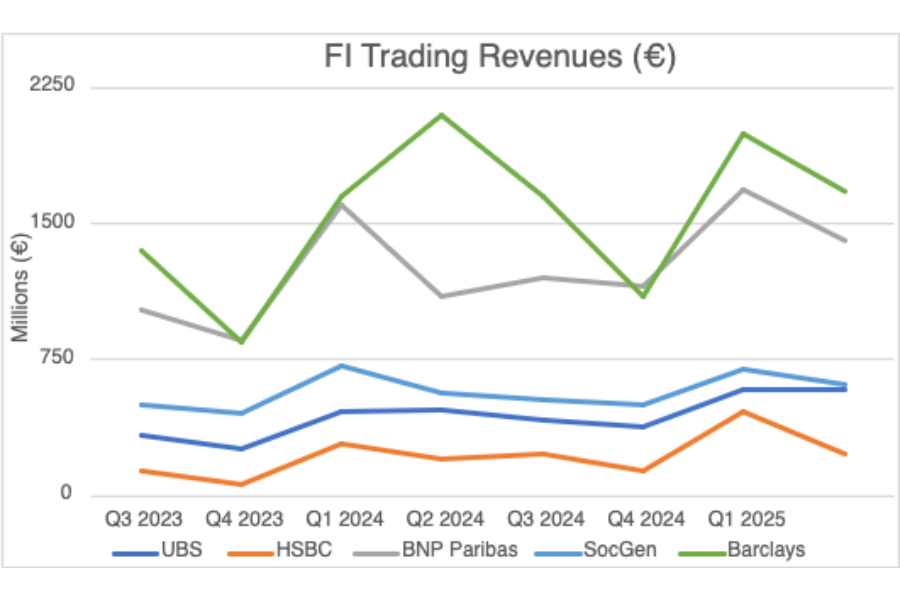

Overall, fixed income trading revenues saw a universal QoQ decline across non-US banks, while the league table remained unchanged both QoQ and year-on-year YoY.

Barclays retained its top spot, continuing its recovery from a Q4 2024 dip that saw its fixed income trading revenues fall behind perpetual runner-up BNP Paribas. The bank reported €1.7 billion over the quarter, a 16% decline quarterly and a 20% drop YoY.

In its earnings call, group finance director Anna Cross noted, “We [managed] risk well, maintaining stable VaR and incurring two trading book loss days, one in April and one in May, in line with the average since 2019. Looking at our income by product, SIC rose 35%, reflecting growth across the credit and macro franchises and in financing. The mix of our macro business weighted towards rate and FX was well suited to activity in the quarter.”

Competition between SocGen and UBS tightened in the second quarter, with the banks reporting €615 million and €584.5 million respectively.

This represented a 12% decline QoQ for SocGen, and a negligible 0.7% drop for UBS. The banks have moved in close tandem since Q2 2024, with this round of results potentially marking a moment of change for the pair. YoY, Soc Gen was up 8% and UBS up 23%.

UBS group chief financial officer Todd Tuckner observed, “Revenues in markets increased by 26%, tracking the exceptional levels of volatility experienced at the start of the quarter.

“Notably, our leading FX trading capabilities helped us to capture client demand for hedging products amid FX volatility in the quarter. Looking ahead, we expect our markets performance in Q3 to reflect seasonality and more normalised levels of trading activity and volatility, both sequentially and versus the prior year quarter.”

HSBC’s fixed income trading revenues declined sharply from a Q1 spike, with €229.7 million representing a 50% decline QoQ – but a 13% increase YoY. Figures for the bank have been calculated based on full year 2024 reports, as HSBC no longer breaks down its equity and FICC trading revenues.

©Markets Media Europe 2025