Can you guess which market has seen the greatest fall in bid-ask spreads, year-to-date?

Two weeks ago, we asked what was crushing the US investment grade (IG) market’s bid-ask spread. However there has been an even greater reduction...

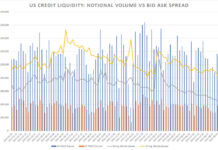

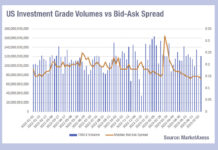

What is crushing the bid-ask spread in US IG?

The bid-ask spread in US investment grade credit has been falling this year, regardless of the trading volume activity.

Notional traded in the US...

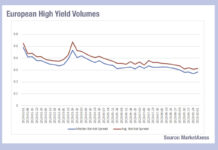

Europe sees big drops in implied liquidity costs

Since the start of 2023, European corporate bonds have seen a greater drop in bid-ask spreads than has been seen in their US investment...

BOB Secondary: US Credit has never had it so good

Liquidity in US credit has improved significantly over the past year, with bid-ask spreads lower than any point in 2022, according to MarketAxess’s CP+...

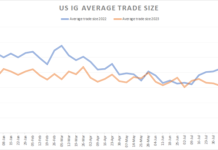

Have US IG trades hit their smallest size this year?

The fires of summer are being replaced by the floods of autumn, but in the bond markets a gentler and more positive outcome is...

Are average trade sizes really falling in the US?

Earlier this year we noted that average trade sizes were down considerably on 2022, but being wary of mean reversion, we wanted to revisit...

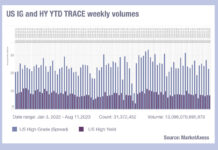

Seize the opportunity to apply AI in quieter bond markets

Secondary credit trading is seeing lower volumes as expected in the summer months, whilst bid-ask spreads have plateaued across Europe and the US markets,...

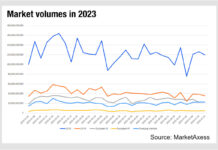

The summer lull barely touches emerging markets

Trading volumes in fixed income markets typically start the year high and gradually fall, matching issuance and refinancing patterns along with investment allocation decisions....

Implied cost of liquidity falling, with US high yield an exception

Volumes in the corporate bond markets have been picking back up, relative to bid-ask spreads, indicating an improving liquidity picture across the US and...

EM stabilising could encourage market makers

Emerging market activity has seen a reduction in volatility in the first half of the year, with both volumes and pricing levels falling slightly,...