US markets seeing risk implied in bid-ask spread

While US stock markets are in turmoil, US investment grade bond markets are also reflecting the greater uncertainty caused by an erratic approach to...

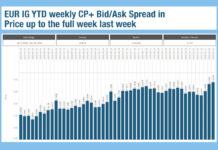

Bid-ask spreads see double-digit tightening in early 2025

Analysis of MarketAxess’s CP+ data, which analyses composite trading costs based on traded bonds, has found that bid-ask-spreads have tightened by double digit percentages...

Emerging markets see liquidity costs decline

The cost of liquidity in emerging markets appears to be falling for fixed income traders. Looking at MarketAxess’s CP+ consolidated price feed, and cross-referencing...

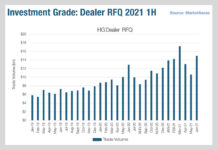

Dealer engagement in multi-dealer platforms is growing

Sell-side firms appear to be increasing their engagement with corporate bond trading platforms. The narrative of increased bilateral trading between dealers and clients...

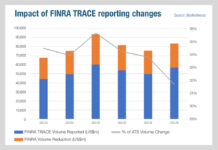

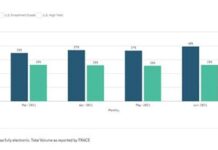

TRACE recalibration exposes double counting

An adjustment to bond trade reporting to TRACE, the US post-trade reporting tape for fixed income, has cut the volume of trades arranged via...

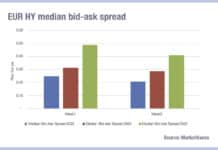

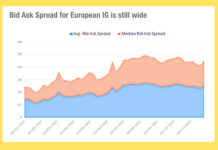

Reviewing 2022: European credit trading costs have doubled

There have been an enormous number of factors shaking up bond trading this year. From fixed income fundamentals like rapidly rising interest rates from...

All I want for Christmas, is trading analytics

Traders would do well to run close analysis over their European trading activity this month, as data from MarketAxess Trax, which tracks trading across...

Squeezing the bid-ask spread

Bid-ask spreads in the corporate bond space have continued to collapse in 2025, suggesting that liquidity costs are dramatically improving for buy-side traders.

Looking at...

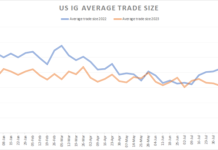

Are average trade sizes really falling in the US?

Earlier this year we noted that average trade sizes were down considerably on 2022, but being wary of mean reversion, we wanted to revisit...

Evidence of trading efficiency from electronification

This week we look at the growth of electronic trading in the US fixed income markets, and the potential it holds to reduce time...