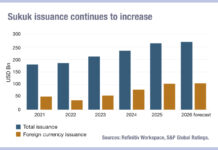

S&P Global: Record sukuk issuance in 2025

S&P Global has reported that global sukuk issuance hit US$264.8 billion in 2025, up from $234.9 billion in 2024, driven by solid economic growth...

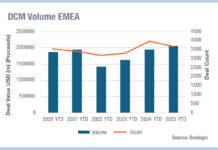

Dealogic: DCM deals in 2025 up 18% on five-year average

The preliminary view of 2025 capital markets deals, published by Dealogic, has found that global DCM volume delivered a total of US$9.5 trillion, 19%...

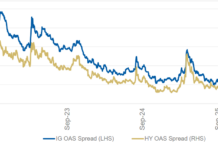

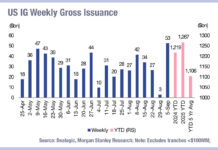

IG issuance across US and Europe up 20% on five-year average

US investment grade debt issuance has hit $1.7 trillion year to date (YTD) in 2025, a 12% increase year on year (YoY). That brings...

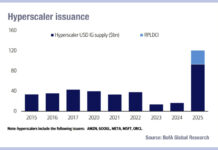

BofA: deluge of hyperscaler issuance steady at US$100bn in 2026

According to Yuri Seliger and Sohyun Marie Lee, credit strategists at Bank of America, in a note published on 17 November, the total of...

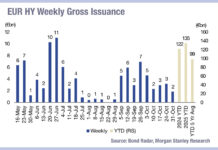

Issuance tracking down in lower rated debt

Issuance of lower rated bonds and leveraged loans across Europe and the US fell in October, according to analysis by investment bank Morgan Stanley,...

Analysing concern around Japan’s government bond issuance and interdealer inefficiency

The appointment of Liberal Democratic Party (LDP) leader Sanae Takaichi as the country’s first female prime minister has drawn comparisons with two of the...

September takes the biscuit in new issues

September did not disappoint in its delivery of high issuance in the US for corporate bonds across both investment grade and high yield. Monthly...

Issuance up in lower rated debt

Analysis by Morgan Stanley’s team has found that, despite the slowing down of bond issuance globally in August, the higher levels of activity in...

September explodes with new corporate bonds

Traders report expectations of outsized corporate bond issuance, with up to US$60 billion expected in US investment grade issuance, and reached $53 billion last...

European debt is standing up for primary markets

Global debt capital market (DCM) deal count year-to-date is down 5% year on year, according to Dealogic data. However, the local market pictures present...