Euronext seeks govies clearing expansion

Euronext Securities Milan has requested LCH open the settlement of all its European government bonds as Euronext seeks to align the services of its...

Clifford drops Citi for BlackRock

Head of trading Paul Clifford has left Citi after more than a decade with the firm, joining BlackRock as a senior multi-asset trader.

He is...

Dincher joins Barclays IB

Jeffrey Dincher has joined Barclays Investment Bank as director of capital markets, conducting research to support the high-yield trading and sales teams.

He is based...

SEC greenlights DTCC tokenisation initiative

The US Securities and Exchange Commission (SEC) has issued a no-action letter to the Depository Trust & Clearing Corporation (DTCC), allowing the company to...

Perkins joins Deutsche Bank

Sean Perkins has joined Deutsche Bank as director of high yield research. He is based in New York.

Perkins has more than 25 years of...

SocGen promotes Braham

Mohamed Braham has been promoted at Societe Generale CIB, being named as head of global markets, and APAC head of fixed income and currencies...

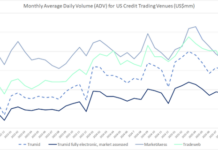

Tradeweb and MarketAxess beat TRACE growth in November

US electronic credit activity firmed in November. On FINRA’s TRACE tape, combined US investment-grade and high-yield average daily volume (ADV) rose to US$57.8 billion,...

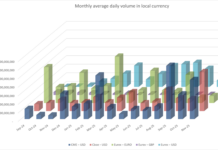

Cboe’s credit futures activity and OI leapfrogs CME and Eurex in November

In November, Cboe’s US dollar iBoxx iShares credit futures set new records with US$455 million in average daily volume (ADV) and US$1.95 billion in...

Jefferies increases credit focus with Hildene acquisition

Jefferies has acquired 50% interest in Hildene Holding Company, parent company of credit-focused Hildene Capital Management and its affiliates.

Hildene Capital Management holds more than...

Lord Abbett invests in IMTC

IMTC has closed a US$12 million Series A funding round, with Lord Abbett joining its ranks of investors.

The round was led by fintech-focused venture...