StoneX builds out FCM presence with RJO acquisition

StoneX Group has agreed to acquire futures brokerage and clearing firm RJ O’Brien & Associates (RJO).

RJO generated approximately US$766 million in revenue in 2024,...

TransFICC secures US$25 million Series B led by Citadel Securities

TransFICC, a provider of low-latency connectivity and workflow services for fixed income and derivatives markets, has secured US$25 million in a Series B fundinground...

Tradeweb launches EGB portfolio trading

Tradeweb has expanded its portfolio trading services to European Government Bonds (EGBs).

Tradeweb has facilitated electronic portfolio trading for corporate bonds since 2019. Responding to...

IMTC picks up another SMA services client

US broker-dealer and wealth manager Amerant Investments has adopted IMTC’s systems as it plans to scale its separately managed accounts (SMA) provisions.

Amerant Investments reported...

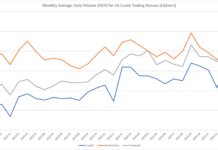

Surge of activity on fixed income trading platforms

MarketAxess has regained the lead in US credit fully electronic trading amid a surge of activity in March with Trace printing a record US$61.2...

Bloomberg rolls events data into single pipe

Bloomberg has launched a new version of its Real-Time Events Data solution,

integrating event data into its B-PIPE market data feed, using identifiers like Financial...

LCH boosts APAC IRS coverage

LCH SwapClear now offers Malaysian Ringgit-denominated non-deliverable interest rate swaps (MYR NDIRS).

Malaysian banks CIMB and Maybank have already cleared the product, with HSBC acting...

Pumped up projections: The Arizona gym muni fraud

The SEC has filed charges against three Arizonian individuals, alleging they defrauded investors by falsifying revenue documents for a US$284 million municipal bond issuance...

Europe avoids tariff panic, awaits US open as currency wobbles

Edging closer to US open, European and Asian markets are resisting panic, according to Eric Boess, global head of trading at Allianz GI.

“I was...

Asia close: Trading desks report tariff impact muted, US open tense

Following Asia market close, trading desks are reporting that the greatest impact from the US tariffs is expected to be seen upon market open...