Jefferies picks Propellant for FI data analytics

Jefferies has selected Propellant Digital to provide data solutions for fixed income markets.

Propellant combines public and proprietary trading data to financial institutions, aiming to...

Trumid zeroes in on data automation, appoints Ryan Gwin

Trumid has expanded its data and intelligence and automation divisions, appointing Ryan Gwin as head of data solutions. The divisions were established four years...

Trump’s SEC backs crypto with Uyeda as acting chairman

Mark Uyeda has been named acting chairman of the SEC.

The Republican commissioner replaces outgoing chair Gary Gensler, and is expected to be in place...

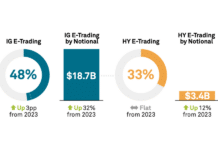

Coalition Greenwich: E-trading boom to outpace market growth in 2025

Nearly half of US investment grade corporate bond trading was electronic in 2024 – and this is only the start, Coalition Greenwich says.

In the...

KNG Securities appoints Edward Williams to emerging markets sales team

Fixed-income investment bank KNG Securities has appointed Edward Williams to its sales team as an emerging markets (EM) specialist.

Williams brings 30 years of experience...

Pham replaces Behnam as CFTC chair

Caroline Pham has been named acting chairman of the Commodity Futures Trading Commission (CFTC), replacing Rostin Behnam.

Behnam announced his departure earlier this month, after...

RBC BlueBay veteran Jewell joins Ninety One

Investment manager Ninety One has named Justin Jewell as co-portfolio manager for its developed markets specialist credit team.

He joins Darpan Harar in overseeing multi...

Diligent and S&P Global Market Intelligence launch insights reporting service

Governance, risk and compliance software firm Diligent has partnered with S&P Global Market Intelligence to launch Diligent Market Insights Reporting.

The service provides reports on...

Schroders picks Propellant for transparency data analytics

Schroders has integrated Propellant Digital’s fixed income transparency data product.

Propellant’s offering provides pre-trade data including real-time market activity, historical trade prices and aggregated trade...

FICC sponsored services use rises as central clearing looms

DTCC’s Fixed Income Clearing Corporation’s (FICC) Sponsored Service volumes reached US$2 trillion in 2024, up 83% year-on-year.

As firms prepare for new requirements around US...