Fidelity International: “A new era for interest rates”

Steve Ellis, global chief investment officer for fixed income at Fidelity International has outlined dynamics which could affect debt markets in 2023.

“Fixed income markets...

ASX loses AUS$250 million on failed blockchain settlement project

The Australian Stock Exchange (ASX) has pulled its project to replace its existing settlement system, CHESS, with a blockchain-based settlement system.

The project, which has...

New York Fed economists see US Treasury liquidity at crisis levels

Current US Treasury market liquidity is comparable with the 2007-09 global financial crisis and the March 2020 crisis, particularly for the two-year note, according...

Tellimer launches end-of-month emerging market bond pricing data

Tellimer Group and information, data & technology provider has launched end-of-month emerging market (EM) bond price data on its global research and data platform,...

US agencies report on US Treasury market changes; market making still out of scope

A new report entitled, ‘Enhancing the resilience of the US Treasury Market’, has outlined the steps taken by US authorities to support what it...

RBC Capital Markets launches Aiden Arrival algorithm

RBC Capital Markets has launched Aiden Arrival, the second algorithm on the firm’s artificial intelligence (AI) -based electronic trading platform. Aiden Arrival follows the Aiden...

ABN AMRO Investment Solutions using BNP Paribas for outsourced dealing

BNP Paribas’s Securities Services business has been selected to provide ABN AMRO Investment Solutions with a range of dealing and middle office outsourcing services....

The Fed’s TMPG begins consultation on clearing and settlement in US Treasury repo

The Federal Reserve Bank of New York’s Treasury Market Practices Group (TMPG) has released a consultative white paper on clearing and settlement in the...

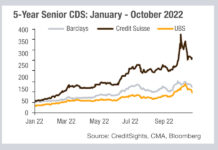

The vicious circle of trust and liquidity

Looking at data provided by CreditSights, we can see the extent of lenders’ concern about Credit Suisse this year. The cost of insuring Credit...

Breaking blocks

Electronic trading is certainly on a growth spurt – Coalition Greenwich reports e-trading was 46% volume across all assets in 2021 – but this...