Sherpa Edge announces client go-live after summer; Lynge Jensen departure

Danish-based outsourced trading provider, Sherpa Edge, has confirmed it is in final negotiations with its first customer, a Danish asset manager, with which it...

Glimpse Markets goes live

Glimpse Markets, the buy-side data sharing service, is officially live with a group of global asset managers sharing post-trade bond data with one another...

Bloomberg, MarketAxess and Tradeweb Markets team up to tackle European consolidated tape

Bloomberg, MarketAxess and Tradeweb Markets today jointly issued the following statement:

“We are pleased to announce an initiative to jointly explore the delivery of a...

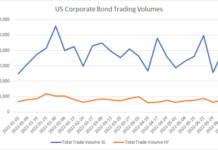

What bouncing US credit volumes tell us in June

Looking at corporate bond trading volumes over the past two weeks, data from MarketAxess appeared to show a recovery since levels plummeted in May...

Alison Hollingshead joins Jupiter AM

Alison Hollingshead has joined Jupiter Asset Management as chief operating officer for investment management.

“I am delighted to be starting my new role as COO,...

Daniel Fields named as TP ICAP’s new CEO of Global Broking division

TP ICAP, the interdealer broker, electronic trading, data and market infrastructure, has appointed Daniel Fields as CEO of its Global Broking division, reporting directly...

LedgerEdge deploys on OpenFin

LedgerEdge, the distributed ledger technology (DLT) bond trading platform, is deploying on OpenFin, the desktop interoperability service. LedgerEdge’s web-based graphic user interface (GUI) will...

Exclusive: US Bank, KeyBanc Capital Markets and Fifth Third Securities join DirectBooks

US Bank, KeyBanc Capital Markets, and Fifth Third Securities have joined the DirectBooks platform, increasing the total to 22 global underwriters on DirectBooks.

Jimmy Whang,...

Coalition Greenwich: 0% impact of ESG on bond trade execution – but is there...

According to new research from Coalition Greenwich, 0% of US-based buy-side bond traders report that environmental, social and governance (ESG) impacted their choice of...

Euronext brings MTS tech in-house with Nexi acquisition

Euronext Group has bought the Nexi technology businesses currently powering MTS, Euronext’s leading fixed-income trading platform, and Euronext Securities Milan, formerly called Monte Titoli.

The...