Christine Kenny announces retirement

Christine Kenny, strategic project leader and Loomis, Sayles & Company and a board member for Natixis International Funds has announced her retirement after nearly...

Joel Kim of Dimensional Fund Advisors on corporate bond liquidity

With Joel Kim, Head of International Fixed Income and CEO Asia ex-Japan, Dimensional Fund Advisors.

Briefly describe Dimensional Fund Advisors, including its fixed income trading...

Bloomberg and Goldman Sachs launch China USD Credit Liquid HY Index family

Bloomberg and Goldman Sachs have launched a Bloomberg China USD Credit Liquid HY Index family, which provides market participants with indices to adjust their...

Tipping Point: CME’s SOFR-linked STIR Futures eclipse Libor-linked STIR Futures for first time

CME open interest data confirms that Secured Overnight Financing Rate (SOFR)-linked short term interest rate (STIR) Futures open interest has, for the first time,...

Quantitative Brokers: Rate futures market susceptible to shocks

A new paper by Quantitative Brokers’ research team, led by Shankar Narayanan has found that the average quote size of many interest rate futures...

Fixed income fees normalising at JP Morgan

JP Morgan’s fixed income revenues in the fourth quarter of this year are expected to be 10% lower than the record final quarter of...

Liquidnet expands continental Europe coverage

Block trading specialist Liquidnet, part of the TP ICAP Group, has expanded its continental European coverage by deploying specialists in equities and fixed income...

Flow Traders joins Neptune as first non-bank sell-side participant in Europe

Flow Traders will become the first non-bank sell-side participant in Europe on Neptune Networks, the fixed income platform for disseminating real-time axe data.

Byron Cooper-Fogarty,...

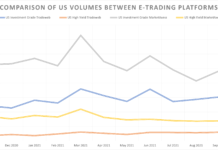

November sees e-trading volumes up

The 2020 pandemic marked a critical turning point for electronic trading in the corporate bond markets according to Tradeweb in the firm’s 2021 letter...

Flow Traders joins MarketAxess as named CP across US HY and Euro IG and...

Flow Traders has committed to become a name-disclosed liquidity provider in US high yield corporate bonds, Euro-denominated investment grade and high yield bonds and...