MarketAxess’s Axess All Prints to offer real-time price transparency in Europe

Fixed income market operator and data provider, MarketAxess, has launched Axess All Prints, a real-time transacted price service for the most actively traded fixed...

Ediphy Analytics announces ten financial institutions working with its consolidated tape

Data analytics provider Ediphy Analytics is now working with over ten global financial institutions, including Norges Bank Investment Management, Deutsche Bank, Citadel Securities and...

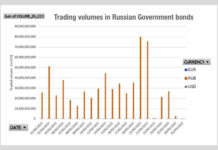

A very clear contrast in trading volumes as sanctions bite

The second chart this week shows trading in Russian government bonds which fell off a cliff at the start of March, triggered by an...

Reports: Ukraine raises nearly US$300 million in bond sale

Ukraine has successfully raised funds in the bond market at a time when Russian debt is becoming untradable. The proceeds from the bonds will...

Union Investment imposes a purchase ban on Russian state bonds and sanctioned companies

Union Investment has decided to impose an immediate ban on the purchase of all securities of the Russian state and a number of Russian...

Liquidnet adds trading in the South African bond market

Block and agency trading specialist Liquidnet, a TP ICAP company, is partnering with TP ICAP South Africa to support bond trading.

The firm reports...

Market reflects grim situation in Ukraine

The invasion of Ukraine on 24 February 2022 by Russia, wedded to subsequent sanctions and travel restrictions have triggered a series of market responses...

JP Morgan FICC e-Trading Survey: Inflation to have biggest impact

The JP Morgan annual fixed income, commodity and currency (FICC) e-Trading Survey has found that inflation is expected to have the greatest effect on...

SoftSolutions’ new testing-as-a-service environment live

SoftSolutions, the fixed income trading technology provider, has announced that a major Scandinavian bank is completing testing of the latest version of nexRates using...

TransFICC launches fixed income consolidated tape pilot

TransFICC, the specialist provider of low-latency connectivity and workflow services for Fixed Income and Derivatives Markets, has launched a new initiative to develop a...