Bloomberg adds Credit Benchmark data to terminal; expands relationship with Lombard Odier

Bloomberg will make Credit Benchmark’s credit risk data – derived from the risk views of global financial institutions – available on the Bloomberg Terminal,...

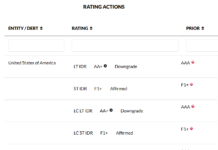

The US: Too big to Fitch?

Ratings agency Fitch has downgraded the United States’ long-term credit ratings to AA+ from AAA and removed the rating ‘Watch Negative’ stating “ reflects...

Moody’s: Speculative-grade credit default rate to rise in 2023

Moody’s Investor Services expects the global speculative-grade corporate default rate to rise in 2023 as slowing economic growth, higher input costs and rising interest...

Implication of US bank downgrades on credit markets

Markets are truly feeling the economic pressures at present, with Moody’s downgrade to US financials on Monday following Fitch’s controversial downgrade of the US,...

Rules & Ratings: S&P warns on forecast uncertainty

S&P Global Ratings has said it believes a high degree of unpredictability exists around policy implementation by the US administration and possible responses regarding...

Katana expands instrument universe by 30,000 bonds

With a reported accuracy of 91%, Katana uses machine learning algorithms and the latest big data technologies to analyse live and up to ten...

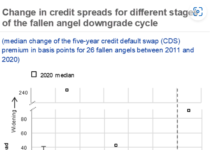

The changing liquidity picture for fallen angels and rising stars

When a company has its credit rating adjusted, the impact on bond liquidity is not entirely predictable. In a changeable rate environment as seen...

Digital bond issuance: From zero to US$1,500,000,000 in 12 months

S&P Global Market Intelligence has assessed that the digital bond market “remains a work in progress” as new bond issuance focuses on testing in...

EM in ‘limbo’ provides trading and pricing challenges

Emerging market bond funds have seen outflows continue to slow significantly, with Morgan Stanley’s analysts estimating it at US$1.8 billion, equating to about 0.42%...

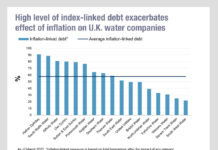

Examining the (Thames) Water fall

In 2013 when markets still looked precarious amid the fallout from the financial crisis, utilities were a good investment.

With a near cast-iron cashflow...

Subscriber