Investor Demand: Oracle balances debt issuance with equity reflecting investor caution

Oracle Corporation announced its full calendar year 2026 plan to fund the expansion of its Oracle Cloud Infrastructure business on Sunday 1 February, to...

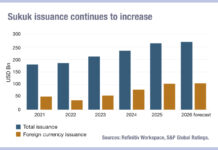

S&P Global: Record sukuk issuance in 2025

S&P Global has reported that global sukuk issuance hit US$264.8 billion in 2025, up from $234.9 billion in 2024, driven by solid economic growth...

Middle East contended by European banks despite US’s EMEA dominance

Dealogic data shows US investment banks have entrenched their dominance across financing in Europe, Middle East and Africa (EMEA).

The latest rankings for the...

Dealogic: DCM deals in 2025 up 18% on five-year average

The preliminary view of 2025 capital markets deals, published by Dealogic, has found that global DCM volume delivered a total of US$9.5 trillion, 19%...

IG issuance across US and Europe up 20% on five-year average

US investment grade debt issuance has hit $1.7 trillion year to date (YTD) in 2025, a 12% increase year on year (YoY). That brings...

Scottish ‘vanity’ issuance project puts investors at risk from independence

The Scottish Government has confirmed plans to enter the bond market and issue £1.5bn of debt in 2026-2027.

Ben Ashby, chief investment officer at...

Investor Appetite: Credit buyers show stiff upper lip

Credit investors have proven resilient to political uncertainty while happy to take up the promised future view of AI application. As a result corporate...

I just dropped in to see what condition my credit was in…

Credit conditions are in the headlines following several private credit defaults, and the debt-fuelled, forward investment in data centres which are expected to underpin...

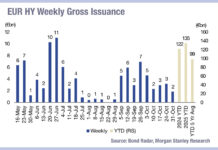

Issuance tracking down in lower rated debt

Issuance of lower rated bonds and leveraged loans across Europe and the US fell in October, according to analysis by investment bank Morgan Stanley,...

Secular vs cyclical: How e-trading, issuance and credit spreads align with liquidity

Primary markets are a crucial source of liquidity in secondary markets, as new issues trigger a round of buying and selling activity for newly...