What’s all the fuss about… the US Treasury market?

Who is kicking up a fuss about US government bonds?

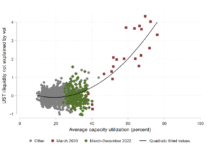

A new paper published by Darrell Duffie for the Jackson Hole Symposium entitled ‘Resilience redux...

Exclusive: Stacey Parsons joins PrimaryBid

Capital markets technology firm, PrimaryBid, has appointed Stacey Parsons as managing director and head of fixed income. Parsons’ appointment is expected to accelerate PrimaryBid’s...

Digital bond issuance: From zero to US$1,500,000,000 in 12 months

S&P Global Market Intelligence has assessed that the digital bond market “remains a work in progress” as new bond issuance focuses on testing in...

Hargreaves Lansdown offers retail investors access to gilts in primary market

Hargreaves Lansdown is giving its clients access to Debt Management Office (DMO) Gilt auctions.

Tim Jacobs, head of primary markets, Hargreaves Lansdown, says, “This...

Liquidnet launches primary bond market offering as buy side demands innovation

Block-trading specialist Liquidnet is launching into the primary market technology space. Its new electronic solution, Liquidnet Debt Capital Markets (DCM), is focused on new...

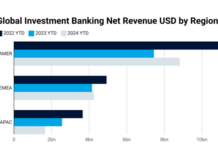

Analysis: Impact of debt issuance on sell-side revenues in Q1

Strong bond issuance in the first quarter (Q1) is galvanising performance of debt capital market teams at investment banks, in turn creating optimism amongst...

EM debt funds on a winning streak for inflows

According to Morgan Stanley analysis, emerging market (EM) debt funds have seen eight weeks of inflows over the summer period, representing the longest streak...

DirectBooks live with euro and sterling investment grade deals

Sell-side consortium DirectBooks, is now live with Euro and Sterling Investment Grade bond deal announcements on its bond issuance platform. The platform launched in...

Let’s be open….

Herb Werth, Managing Director, IHS Markit

As capital markets innovators, one area where we’ve spent considerable time recently has been new issuance. At first glance,...

ISIN at issuance launched for Eurobonds by Origin

Origin Markets, the debt capital markets fintech, is launching an instant-ISIN feature, created in collaboration with international central securities depositary (ICSD) Clearstream, which is...