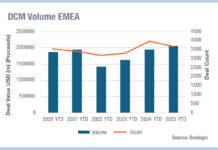

European debt is standing up for primary markets

Global debt capital market (DCM) deal count year-to-date is down 5% year on year, according to Dealogic data. However, the local market pictures present...

Year-to-date issuance higher in corporate bonds as leveraged loans drop

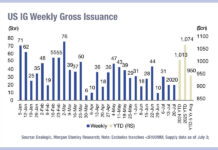

Issuance of corporate debt in the US and European markets is looking relatively strong year to date, however loans have tailed off significantly, according...

Second quarter issuance recovers after soft April and May

Morgan Stanley has reported that June issuance increased 13% year-on-year (YoY) following a 34% drop in April and 3% decline in May.

“Strong June issuance...

TradFi meets DeFi: Integrating FIX and distributed ledgers

Led by global co-chair Digital Assets & Technology Committee, Vince Turcotte, 35 participants from the APAC digital assets ecosystem gathered at the 23rd Asia...

The Book: Orbia prices 2030, 2035 senior notes

Mexico-based industrial product provider Orbia Advance Corporation has announced the pricing of its 2030 and 2035 senior notes.

The international offering was made outside of...

Selling the dip

Credit investors may see the relative calm in the market at present as a point at which to trade into safer positions, according to...

Insights and Analysis: Citadel Securities challenges primary market conflicts

A year ago, rumours in the bond markets suggested that Citadel Securities might be planning a move into bond issuance, a move which buy-side...

CUSIP issuance up YoY, but March decline signals concern

Year-to-date CUSIP issuance, which is indicative of new debt securities being issued, has increased year-to-date against 2024 figures, according to CUSIP Global Services (CGS).

Its latest...

Measuring digital bond issuance

The use of distributed ledger technology (DLT) to issue bonds can tackle several concerns in the debt markets. Firstly, it reduces the fragmented information...

Origination: KfW drives the leading edge of bond issuance

The supranational, sub-sovereign and agency (SSA) bond issuers are expected to be the most forward looking issuer group in evolving primary debt markets.

The DESK...