Exclusive: Stacey Parsons joins PrimaryBid

Capital markets technology firm, PrimaryBid, has appointed Stacey Parsons as managing director and head of fixed income. Parsons’ appointment is expected to accelerate PrimaryBid’s...

Onbrane launches primary debt market blockchain simulator

Onbrane, a provider of short-term debt market digitalisation technologies, has developed a primary debt market blockchain simulator, shadowing real transactions in a virtual blockchain...

Genesis Global launches primary bond market solution for buy side

Low-code application development platform, Genesis Global, has launched a system that aggregates new bond deal data for asset managers, designed to accelerate investment decision...

What’s all the fuss about… the US Treasury market?

Who is kicking up a fuss about US government bonds?

A new paper published by Darrell Duffie for the Jackson Hole Symposium entitled ‘Resilience redux...

Exclusive: Bloomberg and S&P Global Market Intelligence collaborate on bond issuance

Bloomberg and S&P Global Market Intelligence have launched an integrated solution to streamline the syndicated primary bond market lifecycle. Bond market issuance has historically...

Exclusive: BMO Capital Markets, Blaylock Van, and American Veterans Group join DirectBooks

DirectBooks has had BMO Capital Markets, Blaylock Van, and American Veterans Group join its bond issuance platform.

These recent additions increase the total number...

Carl James joins S&P Global

Industry veteran, Carl James, has joined S&P as head of fixed income, for the Global Markets Group (GMG).

In a statement he said, “I...

KfW issues first digital Euro commercial paper via Onbrane

Bond issuance platform, Onbrane, has onboarded KfW, the national development bank of Germany, and processed the first KfW's first Euro commercial paper via Onbrane’s...

Primary markets: Give me some credit: Outlook for bond issuance in 2023

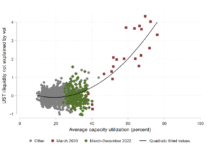

New issues provide liquidity and price points for bond traders; we assess the prospects for the year ahead.

As the cost of borrowing continues to...

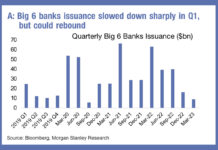

Keep an eye on bank issuance

Bank bond issuance is expected to pick up this year according to research by Morgan Stanley analysts. With deposits proving less attractive as a...

Subscriber