Pre-fight analysis: The weigh-in for CME vs FMX

The launch of FMX, the derivatives exchange chaired by Howard Lutnick, CEO of interdealer broker and services provider BGC Group, sets out a potentially...

Top tips from TradeTech: Connect debt, derivatives and equity trading

Buy-side traders have observed that close ties in the trading team based on the targets on an investment – be that corporate or government...

Derivatives Forum Frankfurt: Efficiency drives towards multi-asset trading

One of the primary reasons for the adoption of multi-asset trading is to improve efficiency, agreed ‘Trends in Multi-asset Trading’ panellists at this year’s...

SGX anticipates Japanese growth with STIR futures

Singapore Exchange (SGX Group) plans to introduce short-term interest rate futures related to the Tokyo Overnight Average Rate (TONA) and the Singapore Overnight Rate...

CME Group set to clear US cash Treasuries

A CME Group representative has confirmed to The DESK that the company is set to enter US Treasury clearing.

The news was first reported...

Exclusive: Karim Awenat promoted at Invesco

Karim Awenat has been promoted to head of EMEA and APAC macro trading at Invesco, which has assets under management of US$1.6 trillion. Awenat...

Coalition Greenwich: Regulation and macro concerns dominate for derivatives users

A new report, ‘Derivatives Market Structure 2024: Focusing on Capital and Workflow Efficiency’, has found that 58% percent of end users of derivatives, and...

FCA consulting on bond and derivative markets transparency reforms

The UK’s Financial Conduct Authority (FCA) is consulting on proposals to improve the transparency regime for bond and derivative markets.

The consultation, which is open...

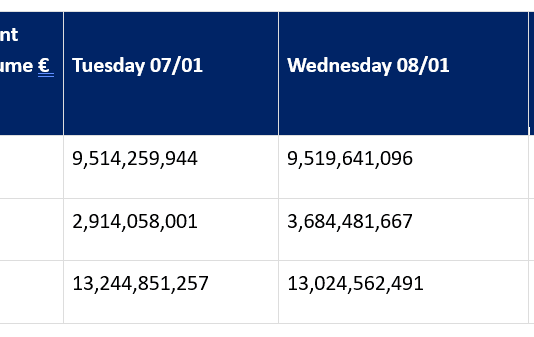

November’s bumper month for fixed income e-trading

Electronic trading platforms have reported a bumper November for fixed income trading, with CME reporting interest rate average daily volume (ADV) up by 42%;...

OTCX registers as MTF as UK trading venue perimeter rules begin

Derivatives trading venue OTCX has been registered as a multilateral trading facility (MTF) in the UK, in the week that the UK’s Financial Conduct...