TransFICC launches eTrading service for interest rate swaps

TransFICC, the specialist provider of low-latency connectivity and workflow services for fixed income and derivatives markets, has launched a new eTrading service, which combines...

Dealers warned about counterparty credit risk by ECB head

Using a blog post, Andrea Enria, chair of the Supervisory Board of the European Central Bank (ECB) has highlighted risks facing the sell-side around...

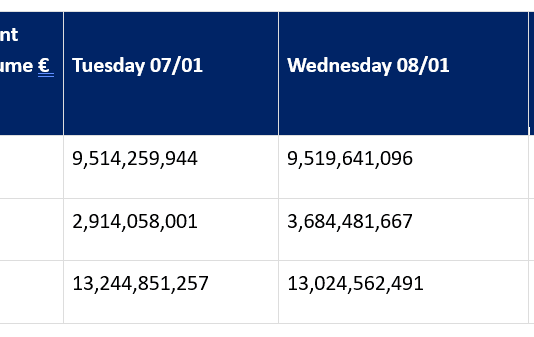

Tradeweb and MarketAxess see credit volumes increase over 25% in December

Market operators MarketAxess and Tradeweb have released their December trading levels, with both seeing a monthly increase of 25% in credit trading average daily...

Chaucer: Cost of insurance against defaults on sovereign debt jumps by 102%

The cost of insuring against sovereign debt defaults has increased by an average of 102% over the past year, according to research by global...

Insight Investment named collateral manager and collateral valuation agent for £1.7 billion longevity swap

Insight Investment, an investment manager with £683 billion (€778.3 billion) assets under management, has been appointed as collateral manager and collateral valuation agent for...

Tradeweb’s October volumes reflect turbulence in European and US markets

Tradeweb, the market operator across rates, credit, equities and money markets, has reported an average daily volume (ADV) for the month of US$1.05 trillion,...

FSB: Greater transparency, all-to-all trading and clearing could reduce rates markets dislocation

A paper by the Financial Stability Board (FSB), which coordinates international regulatory efforts to promote effective policies, has reported that dealer blame uncertainty over...

BoE’s limited window could punish the gilt-y

The Bank of England’s limited UK government bond (gilt) purchase operations have been confirmed to close on Friday, putting tight brackets around buy-side firms’...

Eurex launches the first futures on a Euro High Yield Index

From 17 October 2022, Eurex will offer market participants the opportunity to hedge the Euro-denominated high-yield corporate bond market in Europe.

This segment has been...

Eurex expands FX Futures offering to emerging markets currencies

Eurex will start trading new FX Futures contracts covering Brazilian Real (BRL), Mexican Pesos (MXN) and South African Rand (ZAR) on 10 October 2022....