MarketAxess industry viewpoint

Comparing portfolio trading and list RFQ TCA

By Gio Accurso, Grant Lowensohn and Jessica Hung, MarketAxess

Highlights and objectives

The MarketAxess Research team investigates any key...

Cboe Credit Index Futures: The expanding liquidity picture

As buy-side firms look to increase their exposure to credit futures, market operators find ways to support access.

The DESK spoke with David Litchfield, director...

Why Europe’s electronic credit trading is accelerating

The level of electronic trading in European corporate bond markets has overtaken the US, according to analysis from firms including Propellant and Coalition Greenwich....

ICE: Optimizing the data pipeline for buy-side trading desks

Buy-side bond traders can enhance execution through a flexible data offering.

The DESK spoke with Mark Heckert, ICE’s Chief Operating Officer of Fixed Income...

AiEX Opens New Chapter for Trading in APAC

By Laurent Ischi, Head of APAC Automation, Tradeweb.

When it comes to the increased adoption of electronic trading in interest rate swaps and other derivatives...

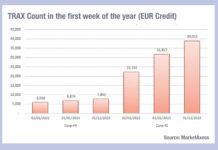

Does this year start with the smallest trades ever?

Trading activity in European bond markets at the start of 2024 has had the highest trade count of the past three years by some...

Industry viewpoint: A fully formed market from day one

Angelo Proni, CEO at Euronext Group’s MTS explains how electronic market making will increase transparency and liquidity of EU debt instruments and make them...

Viewpoint: Tapping the expanding universe of credit futures and options

Cboe has launched options on Cboe iBoxx iShares Corporate Bond Index futures, and widened its trading hours to further expand the user base and...

ICE: For asset owners, a better way to manage rate volatility

How sophisticated pricing & analytics can inform better risk management and asset allocation choices.

By Patrick Ge, CFA, Fixed Income Specialist, Product Management & Neil Patel,...

The right tools for trading: Tim Monahan, ICE

Tim Monahan, senior director of product management at ICE explains how ICE continues to develop services and products that better support traders in fixed...