Research profile: Neptune shines bright

The DESK spoke with Byron Cooper-Fogarty, CEO of Neptune, to understand how it keeps delivering for buy-side users.

Axe streaming service, Neptune, has continued to...

Subscriber

CTP authorisation duration remains unknown

While the CTP selection process is keeping to ESMA’s intended timeline, there is still uncertainty around when the tape will be implemented.

Once a provider...

E-trading stumbles in US credit

E-trading in high yield (HY) US credit reduced year-on-year (YoY) in February, despite rising average daily trade sizes.

After taking almost a third of traded...

Location will determine bid-ask spreads for European bond traders

Where European bond traders and their counterparties are sat could affect the size of bid-ask spreads they are shown, thanks to a split in...

J.P. Morgan: Survey reveals specific growth opportunities for electronic trading

Expectations of volatility jump as traders across the market seek liquidity and cost management through single dealer platforms.

J.P Morgan’s annual E-trading Edit, a comprehensive...

ICE: Indexing – the next evolution

ICE offers advancements with customisation, AI and a depth of historical data

The DESK spoke to Varun Pawar, ICE Fixed Income & Data Services’ Chief...

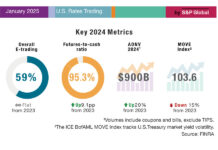

E-trading static but competition rises in US rates

Although US rates trading volumes were up 20% year-on-year, the proportion of that volume e-traded remained static. “We don’t expect this metric to move...

Insights & Analysis: Investors’ Gilt-y pleasure

Markets have turned positive on UK government bonds, which rallied across the curve following the release of unemployment data indicating a higher rate and...

Fixed Income Automation Surge: 60% of Credit Traders Now Use Robots

The electronification of fixed income markets is accelerating, driven by increased adoption of automated trading systems, with 60 per cent of credit market participants...

The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...