Cross-asset TCA is viable in credit markets

Can transaction cost analysis (TCA) provide an apples-for-apples comparison of buy-side trading costs across different asset classes? Imposing a single measurement framework across markets...

Bid-ask spread volatility highest in US bond markets

When comparing liquidity across markets in 2025, buy-side bond traders may consider European investment grade markets to have an optimal set of characteristics. However,...

US credit activity dropped off a cliff in late November

Analysis of US corporate bond market activity has found that trading volumes and counts plummeted going into the final month of the year. A...

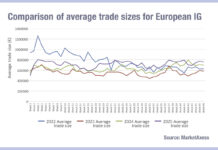

Credit trades’ double-figure yearly growth proves liquidity dividend

The gradual growth in trade sizes for European corporate bond trades is made clear in the latest MarketAxess TraX data comparison for data from...

Milei’s victory saw Argentinian debt traders reach for rapid risk transfer

In late October 2025, Argentine President Javier Milei’s party, La Libertad Avanza, scored a decisive win, in the country’s midterm elections, a political triumph...

Investor Appetite: Credit buyers show stiff upper lip

Credit investors have proven resilient to political uncertainty while happy to take up the promised future view of AI application. As a result corporate...

Bid-ask spreads expanding in European credit

European credit traders have seen bid-ask spreads expand over the past two weeks, however this follows a notable tightening since summer, according to data...

FCA estimates revenue from UK consolidated tape to be £4 million over five years

Attendees at the Fixed Income Leaders Summit in Amsterdam were told to get ready for the arrival of the consolidated tape in Europe, with...

Why humans give the best execution

Understanding best execution requires an understanding that both explicit and implicit costs can have a serious impact on investment goals, and these often reach...

FILS EU 2025: Traders need to take control of their future

While the European and UK consolidated tape fiascos are dominating gossip around the Fixed income Leaders Summit in Amsterdam, other big themes are clearly...