What’s up EM?

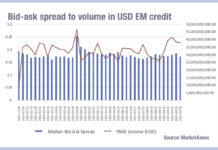

Emerging market volumes have jumped in September, hitting levels not seen since April 2025, when the US trade taxes on imported goods from every...

Quantum computing ‘breakthrough’ has “more red flags than a People’s Liberation Army parade”

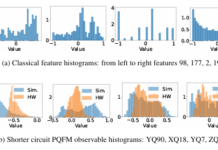

The claim by HSBC that noise in an IBM quantum computer helped deliver a 34% improvement in algorithmic trading performance has been disputed by...

Quantum leap: HSBC, IBM improve bond RFQ fill rate by 34%

HSBC and IBM have reported a 34% improvement in fill-rate modelling for bond request-for-quote (RFQ) using quantum-generated features and common data science algorithms.

The bank–technology...

It is EMS time for credit traders

The value proposition for execution management systems (EMSs) in fixed income markets has seen an about face in the past year. Buy-side firms who...

TradeTech FX: Multi-asset trading success conditional on buy-side objectives

The value of multi-asset trading desks to an investment manager is conditional on the goals of the buy-side firm aligning with the firm.

At TradeTech...

Bond traders predict data science/AI use explosion in 2026

The DESK’s Corporate Bond Liquidity Access Survey, supported by LTX, finds trading desks are on the cusp of change.

Buy-side traders see 2026 as a turning...

Subscriber

BNY and Goldman Sachs launch tokenised money market fund shares

The Bank of New York Mellon Corporation and Goldman Sachs have announced a collaborative initiative in which BNY is expected to use blockchain technology...

Have credit e-trading platforms just been liberated in US markets?

The removal of key legislative proposals in the US capital markets is potentially allowing electronic trading platforms to develop entirely new ways of trading...

Intelligent application of artificial intelligence in credit

A picture has emerged of the future credit desk for buy-side traders, from discussions at the Fixed Income Leaders’ Summit in Washington DC last...

Complex environment requires multi-model approach to data science

In fixed income, the most effective investment and trading models can be those built to withstand uncertainty. Speaking at the Fixed Income Leaders’ Summit...