How e-trading won bond investors an opportunity in the Venezuelan crisis

The dramatic escalation of Venezuela’s political crisis — culminating in the US military operation that removed Nicolás Maduro from power — has triggered a...

Visualising the cost of credit trading cut in half since 2023

Credit markets have seen bid-ask spreads, a proxy for trading costs for the buy-side, tighten further in the first two weeks of 2026, relative...

J.P. Morgan Execute powers the future of e-trading

Close teamwork is seamlessly delivering sophisticated services to the users of J.P. Morgan’s Execute platform.

J.P. Morgan’s Execute platform has 4,000 users globally, and facilitates...

Are bigger trades always better?

Average trade sizes appear to have been increasing in corporate bond markets in recent years. Superficially this might suggest a greater dealer capacity to...

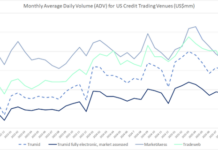

Tradeweb and MarketAxess beat TRACE growth in November

US electronic credit activity firmed in November. On FINRA’s TRACE tape, combined US investment-grade and high-yield average daily volume (ADV) rose to US$57.8 billion,...

How a credit sell-off might unfold…

Someone, somewhere, is cooking the books

In 2007, I explained the risks of cumulative capital market investments to a friend as a series of interconnected...

Milei’s victory saw Argentinian debt traders reach for rapid risk transfer

In late October 2025, Argentine President Javier Milei’s party, La Libertad Avanza, scored a decisive win, in the country’s midterm elections, a political triumph...

IOSCO sets pre-hedging guard rails, amid calls for ban

The International Organisation of Securities Commissions (IOSCO), has published its final report on pre-hedging, amid call for the practice to be banned, and allegations...

I just dropped in to see what condition my credit was in…

Credit conditions are in the headlines following several private credit defaults, and the debt-fuelled, forward investment in data centres which are expected to underpin...

Secular vs cyclical: How e-trading, issuance and credit spreads align with liquidity

Primary markets are a crucial source of liquidity in secondary markets, as new issues trigger a round of buying and selling activity for newly...