Trumid collaborating with Jefferies in EM credit trading

Bond market operator, Trumid, is collaborating with Jefferies in emerging markets (EM) credit trading.

Jefferies will use Trumid’s Attributed Trading (AT) protocol and workflow solutions...

Traders welcome India’s bond e-trading evolution as regulator shows teeth

The Indian bond market provides a conundrum for investment traders, who fight to gain access to liquidity and pricing information on behalf of their...

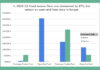

Why Europe’s electronic credit trading is accelerating

The level of electronic trading in European corporate bond markets has overtaken the US, according to analysis from firms including Propellant and Coalition Greenwich....

Who is using outsourced trading?

A new study by analyst firm Capco has outlined the drivers, pros and cons for buy-side outsourced trading, yet Capco was unable to say...

Money market and repo platforms see big volumes; MTS widens footprint

The European Central Bank estimated turnover in wholesale unsecured money markets in Europe alone was €127 billion (US$137 billion) per day in Q1 2020....

List trading goes live on MTS BondsPro all-to-all order book

MTS Markets , part of London Stock Exchange Group (LSEG), has added list trading functionality to its MTS BondsPro corporate bond trading platform, enabling...

How to trade for alpha

Smart institutional trading desks can boost returns in support of investment management. Dan Barnes reports.

If institutional portfolio management (PM) and investment trading were separated in...

Why humans give the best execution

Understanding best execution requires an understanding that both explicit and implicit costs can have a serious impact on investment goals, and these often reach...

OpenDoor launches all-to-all platform in US Treasury market

OpenDoor Securities has launched a trading platform focussed on the less liquid segments of the US Treasury bond market. Nearly three dozen firms representing...

B2Scan closes down

B2Scan, the pre-trade liquidity data platform for bond markets, has shut down after eight years. The CEO and founder of B2Scan, Frédéric Semour, was...