Smart institutional trading desks can boost returns in support of investment management. Dan Barnes reports.

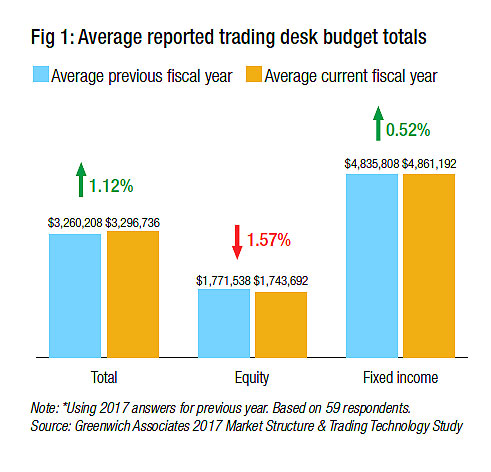

If institutional portfolio management (PM) and investment trading were separated in a Venn diagram, ‘generating alpha’ would traditionally sit comfortably in the PM set. Yet increasingly it is moving into the overlap between trading and the PM function. As it moves, it can push trading from a cost centre for which budgets are largely frozen (See Fig 1) into a profit centre through integration with investment, and expansion of capabilities.

“Years ago fund managers picked bonds that they liked, sent that to the trading desk, if the trading desk was not able to source bonds, the portfolio manager would yell at the traders,” says Tim Morbelli, vice-president of credit trading at AB Global, which manages US$554 billion assets under management (AUM). “What’s changed is we have brought that liquidity conversation, which was usually the last part of that, to the front of the discussion.”

The motivation behind the change is twofold. Firstly, active managers need to better manage costs as they see passive investment products soak up ever higher levels of investment. Secondly, the maturity of trading functions is enabling them to deliver returns in line with investment strategies. The regulatory pressure to optimise execution is a subtle dynamic encouraging this trader evolution.

“MiFID I in the equity market allowed the dealing desk to develop added value by setting up new technology, connecting to liquidity pools, and providing new transaction costs analysis (TCA),” says Laurent Albert, global head of trading at Natixis Asset Management Finance which manages €324.5 billion (US$400.8 billion) in AUM. “MiFID II will impact the relationship between the dealing desk and portfolio manager in fixed income by letting the trader set up new crossing networks, catch up liquidity and also provide new TCA.”

Where a portfolio manager sets the course, the trader navigates the waters. Their ability to do that is dependent on their resources and integration with portfolio management alongside skills, access to information and interfaces to analyse that information.

“For the large asset managers, traders can provide quite a bit of value back,” says Kevin McPartland head of market structure and technology research at Greenwich Associates.

Basic strengths

With the growing electronification of trading the execution of orders alone is not enough to justify a trader’s cost.

“The dealer’s intimate involvement with execution is changing as orders migrate to electronic trading,” says Matthew Hodgson, CEO and founder at Mosaic Smart Data. “The question is then about the value add they can offer on a more subtle level to improve performance.”

Asset selection is the fundamental level at which any buy-side trader can support portfolio returns, a necessary role where the portfolio manager has moved away from trading on the market directly, and needs that colour on the market.

“The portfolio manager may have selected to purchase a bond with particular attributes. However, if the liquidity of that bond is problematic, many proactive buy-side traders are now actively presenting alternatives with similar attributes to the PMs, whether in primary or secondary markets,” says Stephen Grady, head of market structure, at primary market specialist Ipreo.

Dedicated tools that help to assess pricing and liquidity in the markets support the traders’ abilities, as do strong relationships with the sell-side.

Research by Greenwich Associates published in Q1 2018 found that budgets for fixed income trading desks increased by just 0.52% between the 2017 and 2018 fiscal years while the proportion of budget allocation for compensation fell from 70% in 2015 to 59% in 2017, the rest of the budget being taken up by technology spend.

“Analytics are needed to understand the order flow patterns, the diagnostics, being able to understand down to the transaction layer to see what is going on whether they are getting the performance from the liquidity providers they are going to,” says Hodgson. “Then it comes down to more granular layers like instrument selection and where liquidity sits. You start with a macro view and then drill down into the specific of where you can add value.”

Of the current investments measured by Greenwich, the most significant increases in tech project spend were on TCA – rising from 3% to 5% between 2015 and 2017 – and on risk/portfolio analytics which increased from 6% to 10% over the same period.

By integrating awareness of the portfolio and risk management into trading activity, traders are able to act with greater autonomy because they are aligned with the mandate of a fund or client.

“A trading desk is necessary to enable portfolio management teams to focus on delivering alpha while operating in an efficient, secure and flexible framework that meets best practice standards,” says Albert. “We provide our clients with access to improved liquidity channels, we offer a customised experience and the ability to integrate trading solutions within client specific environments.”

Morbelli says, “The first thing we talk about is what is available, what is going on in the market place, what are the technicals driving the market right now? Then, where do we see opportunity? Once we have that information we discuss the next part of what are we trying to accomplish in our portfolios. What do we want our risk budget to be, what part of the curve, what bonds, etc. Then we bring in the fundamentals, overlay that and that’s how we populate the risk.”

The value of choice

The opportunities that a firm has to trade are increased because the desk gains agility through its integration. That is further enhanced by the range of instruments, venues and order types available to it.

“The key benefits of a dealing desk are the ability to create cost efficiencies through reduction of infrastructure investments and trading costs; access to more developed dealing techniques and teams; and the ability to trade anonymously in the market if required,” says Albert.

He notes that crossing internally can be one good model for an asset manager to reduce market impact, although there is both a technology aspect in working across the different portfolio managers’ systems and a timing element, as internal crosses will not always naturally occur simultaneously. Consequently they are one string to a trader’s bow.

“For the largest firms their scale means they need to find efficiencies in how they trade,” says McPartland. “You don’t want one portfolio manager selling US$10 million of US treasuries and another buying them at the same time, with those trades executed out in the market without knowledge of the other.”

That extends to instrument selection and an assessment of post-trade elements where for best execution purposes selecting the right bond or product can have important consequences for speed and cost.

McPartland continues, “There are implications for fees and collateral, basis risk, a whole host of other things that are more suitable for the trading desk to assess [than the PM]. You want the portfolio managers to focus on the strategy.”

Agility and alpha

Accessing these other instruments also allows the trading desk to take risk on and off in a more efficient manner, potentially generating returns for the customer.

“We do use swaps for basis opportunities, also when we can employ portfolio overlays, which we have recently done,” says Morbelli.

“Volatility lets active managers shine, and that’s what we offer here, through our investment process we understand how to manage a portfolio without sacrificing attractive positioning. Overlays are very easy to take off which helps to manage the liquidity of a portfolio without sacrificing your positioning.”

Spotting arbitrage opportunities when new issues are offered against current outstanding bonds with similar characteristics and similar issuer profiles also allows the trading team to identify relative value trades which can be used to deliver the same or improved returns to the portfolio at a reduced cost.

“Where our analysts have a strong fundamental view of a credit we then have relative value discussions, and if we see those opportunities we can pounce on them,” says Morbelli. “Most of our accounts are performance based versus their respective benchmarks. We analyse the security attribution to determine the impact of the securities we owned versus the benchmark to capture the alpha generated from the trading team.”

©Markets Media Europe 2025