Port in a storm: Asian international bond markets resilient amid volatility

Volatile interest rates, a fractious geopolitical landscape, and rumbles in the Chinese property sector. Despite these headwinds, the international bond markets in Asia were...

Subscriber

November’s bumper month for fixed income e-trading

Electronic trading platforms have reported a bumper November for fixed income trading, with CME reporting interest rate average daily volume (ADV) up by 42%;...

What’s all the fuss about… the US Treasury market?

Who is kicking up a fuss about US government bonds?

A new paper published by Darrell Duffie for the Jackson Hole Symposium entitled ‘Resilience redux...

LatAm sees e-trading momentum with support for all-to-all

In Latin America, 46% of trading in corporate hard currency bonds is conducted electronically, according to research by analyst firm Coalition Greenwich, compared to...

Review: An apples-to-apples comparison of all-to-all trading platforms

We compare the very different all-to-all offerings provided by electronic trading platforms.

A good all-to-all offering can really support electronic liquidity provision, especially if traditional...

Review: Mixed bond trading revenues in choppy first quarter

Banks have seen mixed results from bond trading in the first quarter of 2023, across credit and rates, while electronic trading platforms have seen...

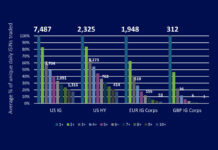

Electronic credit platforms report fresh rises in trading volumes for March and Q1

Electronic bond market operators saw a new boost to volumes in March, and in the first quarter more broadly, as volatility in capital markets...

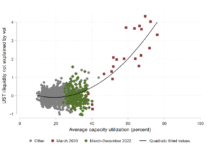

Federal Reserve: Dealer sensitivity major barrier to all-to-all trading in US Treasuries

A new staff paper published by the Federal Reserve Bank of New York has found there are possible advantages in delivering all-to-all trading to...

Editorial: Asset managers wilt as banks impose hose-pipe ban

In the UK, during dry conditions, the government bans the public from using hosepipes in order to conserve water. In 2022, the sell side...

MarketAxess Mid-X launches in US

MarketAxess has made Mid-X, its anonymous session-based matching protocol, live for US market participants after its initial launch in Q4 2020 with European participants.

The...