How the Trumid takeover will affect Electronifie traders

All-to-all US bond trading platform Trumid has agreed to buy fellow all-to-all trading platform Electronifie. Upon closing, the deal will mean the Trumid user...

“There is no liquidity”: Bond traders report market conditions never seen before

Buy-side bond traders are facing a considerable challenge in matching their investor’s demand for fixed income assets as equity markets plummet. Volumes are up,...

OpenDoor launches all-to-all dark pool for on-the-run US Treasuries

OpenDoor Securities has launched an all-to-all marketplace for on-the-run (OTR) US Treasuries. The anonymous order book will US Treasury venue to offer non-discriminatory pricing in benchmarks...

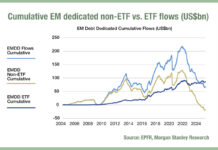

Inflows to EM debt beta funds could change trading patterns

Emerging market (EM) exchange traded funds (ETFs) have seen cumulative inflows of US$1.9 billion year to date, according to analysis by Morgan Stanley, while...

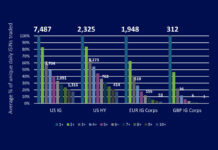

Greenwich Associates: Buy side negative on CLOB for US treasuries

By Flora McFarlane.

Only 16% of buy-side firms thought using a central limit order book (CLOBs) would have a positive impact on trading US treasuries,...

Editorial: Asset managers wilt as banks impose hose-pipe ban

In the UK, during dry conditions, the government bans the public from using hosepipes in order to conserve water. In 2022, the sell side...

Bloomberg: No charge for buy-side fixed income trading

Bloomberg has quashed rumours that buy-side traders are to be charged for fixed income trading in 2021. Buy-side traders had reported to The DESK...

Electronic credit platforms report fresh rises in trading volumes for March and Q1

Electronic bond market operators saw a new boost to volumes in March, and in the first quarter more broadly, as volatility in capital markets...

State Street introduces buy-side to buy-side repo programme

State Street has launched a new peer-to-peer repo programme for the buy side. Building out from its sponsored repo and securities lending model, including...

Tradeweb sees volume drop in June

Bond market operator, Tradeweb, has reported its average daily volume (ADV) in June was US$780.9 billion (bn), a decrease of 8.9% year-on-year (YoY), largely...