Are bigger trades always better?

Average trade sizes appear to have been increasing in corporate bond markets in recent years. Superficially this might suggest a greater dealer capacity to...

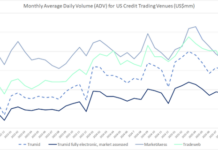

Tradeweb and MarketAxess beat TRACE growth in November

US electronic credit activity firmed in November. On FINRA’s TRACE tape, combined US investment-grade and high-yield average daily volume (ADV) rose to US$57.8 billion,...

Secular vs cyclical: How e-trading, issuance and credit spreads align with liquidity

Primary markets are a crucial source of liquidity in secondary markets, as new issues trigger a round of buying and selling activity for newly...

Why humans give the best execution

Understanding best execution requires an understanding that both explicit and implicit costs can have a serious impact on investment goals, and these often reach...

“A fixed income price is not a fact. A fixed income price is an...

David LaRusso is the head of fixed income trading at Dimensional Fund Advisors, and has just celebrated his 25th anniversary at the firm. The...

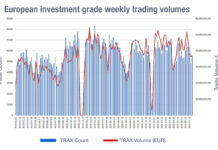

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

Signalling risk in credit, if one counterparty is 50% volume

How do you avoid information leakage? Does this change if half the market is trading with a single counterparty? Knowing that electronic market maker,...

Crunch on liquidity costs

As bid-ask spreads begin to widen on both sides of the Atlantic, buy-side credit traders need to reassess how to best manage the crunch...

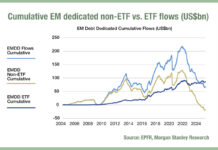

Inflows to EM debt beta funds could change trading patterns

Emerging market (EM) exchange traded funds (ETFs) have seen cumulative inflows of US$1.9 billion year to date, according to analysis by Morgan Stanley, while...

Fixed Income Automation Surge: 60% of Credit Traders Now Use Robots

The electronification of fixed income markets is accelerating, driven by increased adoption of automated trading systems, with 60 per cent of credit market participants...