IRS electronification: 20 years in the making

With the 20th anniversary of Tradeweb’s interest rate swaps (IRS) marketplace around the corner, the firm’s head of US institutional Rates, Bhas Nalabothula, looks...

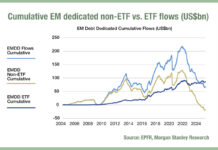

Inflows to EM debt beta funds could change trading patterns

Emerging market (EM) exchange traded funds (ETFs) have seen cumulative inflows of US$1.9 billion year to date, according to analysis by Morgan Stanley, while...

Why Europe’s electronic credit trading is accelerating

The level of electronic trading in European corporate bond markets has overtaken the US, according to analysis from firms including Propellant and Coalition Greenwich....

The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...

Coalition Greenwich: US Treasury e-trading volumes hit record in February

US Treasury volumes saw an average daily notional value (ADNV) of US$918 billion in February 2024, Coalition Greenwich’s March Data Spotlight has reported, up...

Signalling risk in credit, if one counterparty is 50% volume

How do you avoid information leakage? Does this change if half the market is trading with a single counterparty? Knowing that electronic market maker,...

Tradeweb reports ADV in June up 35% year-on-year

Tradeweb has reported that its total trading volume for June 2021 reached US$23.1 trillion. Average daily volume (ADV) for the month was US$1.05 trillion,...

November’s bumper month for fixed income e-trading

Electronic trading platforms have reported a bumper November for fixed income trading, with CME reporting interest rate average daily volume (ADV) up by 42%;...

Fixed Income Automation Surge: 60% of Credit Traders Now Use Robots

The electronification of fixed income markets is accelerating, driven by increased adoption of automated trading systems, with 60 per cent of credit market participants...

MarketAxess rides all-to-all and volume growth to record revenues in Q1

Bond market operator MarketAxess has reported Q1 2021 revenues of US$195.5 million, up 16% on the previous year and a company record. While Q1...