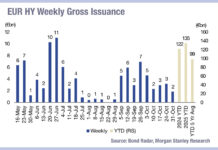

Issuance tracking down in lower rated debt

Issuance of lower rated bonds and leveraged loans across Europe and the US fell in October, according to analysis by investment bank Morgan Stanley,...

Secular vs cyclical: How e-trading, issuance and credit spreads align with liquidity

Primary markets are a crucial source of liquidity in secondary markets, as new issues trigger a round of buying and selling activity for newly...

Bid-ask spreads expanding in European credit

European credit traders have seen bid-ask spreads expand over the past two weeks, however this follows a notable tightening since summer, according to data...

FCA estimates revenue from UK consolidated tape to be £4 million over five years

Attendees at the Fixed Income Leaders Summit in Amsterdam were told to get ready for the arrival of the consolidated tape in Europe, with...

Quant funds assess the value of trading

There are huge variations in investment and trading activity across quantitative strategies, the Fixed Income Leaders Summit heard in Amsterdam on Wednesday, and the...

Aligning the pre-trade credit liquidity picture and the execution goal

Pre-trade data and market colour are imperative for buy-side traders looking to achieve best execution in corporate bond markets. Understanding how that applies to...

September takes the biscuit in new issues

September did not disappoint in its delivery of high issuance in the US for corporate bonds across both investment grade and high yield. Monthly...

“A fixed income price is not a fact. A fixed income price is an...

David LaRusso is the head of fixed income trading at Dimensional Fund Advisors, and has just celebrated his 25th anniversary at the firm. The...

Quantum computing ‘breakthrough’ has “more red flags than a People’s Liberation Army parade”

The claim by HSBC that noise in an IBM quantum computer helped deliver a 34% improvement in algorithmic trading performance has been disputed by...

It is EMS time for credit traders

The value proposition for execution management systems (EMSs) in fixed income markets has seen an about face in the past year. Buy-side firms who...