Signalling risk in credit, if one counterparty is 50% volume

How do you avoid information leakage? Does this change if half the market is trading with a single counterparty? Knowing that electronic market maker,...

E-trading boosts efficiency not liquidity in Japan’s buy-and-hold bond market

Japan’s bond market has long been seen as voice-heavy, with established traditions of relationship-based trading and an aversion to electronic, less personal alternatives. However,...

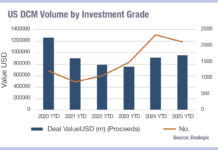

US bond deals fragment as EMEA consolidates

The latest breakdown of debt capital market (DCM) issuance by Dealogic has found that deal numbers in the US have declined slightly year-to-date versus...

Do Europe’s credit trading costs invert the pattern for US debt trades?

An analysis of average bid-ask spreads in corporate bond markets across the European and US markets suggests that median bid ask spreads responses are...

Origination: Will Germany support European debt mutualisation?

UBS Asset Management’s Jonathan Gregory, head of UK fixed income, has posited the idea that European countries may at some point seek to mutualise...

Electronification of US credit delivers resilience

The electronification of the US corporate bond markets has demonstrated that its improved efficiency has strengthened depth of liquidity provision, rather than made it...

“There is still an edge in systematic trading”

Systematic trading is often associated with highly liquid instruments, but asset managers have outlined success stories in less liquid debt markets, at the Fixed...

Portfolio trading proves transformational, but controversial

The US market has been transformed by portfolio trading (PT) this year, with estimates that PT makes up somewhere between 25-40% of dealer-to-client (D2C)...

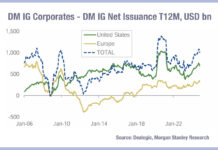

Primary held in check by tariff and rate uncertainty

Gross credit issuance has fallen in developed markets, according to data from Dealogic and Morgan Stanley, across investment grade (IG) and high yield (HY).

DM...

Origination: Government bond supply next week

Nominal supply of bonds scheduled in the Euro area next week is expected to level at €17.8 billion of European government bonds (EGBs), according...