What’s all the fuss about… the US Treasury market?

Who is kicking up a fuss about US government bonds?

A new paper published by Darrell Duffie for the Jackson Hole Symposium entitled ‘Resilience redux...

Portugal to join FTSE World Government Bond Index; India deferred

Portugal has been added to the FTSE World Government Bond Index (WGBI), effective November 2024. FTSE Russell stated that the country now meets all...

Can you guess which market has seen the greatest fall in bid-ask spreads, year-to-date?

Two weeks ago, we asked what was crushing the US investment grade (IG) market’s bid-ask spread. However there has been an even greater reduction...

Muting Ren joins American Century Investments

Muting Ren has joined American Century Investments on its global Fixed Income Team. He will serve as senior portfolio manager and head of systematic...

Origination: Government bond supply next week

Nominal supply of bonds scheduled in the Euro area next week is expected to level at €17.8 billion of European government bonds (EGBs), according...

OpenDoor nets US$10 million in continuing push for growth

By Flora McFarlane.

New Jersey-based startup trading platform OpenDoor Securities has completed a third US$10 million investment round, which will facilitate new front office hires...

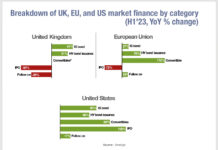

Issuance of debt increasingly financing UK companies

Analysis of corporate financing across European, UK and US markets by the Association of Financial Markets in Europe (AFME) has found that over the...

Electronic credit platforms report fresh rises in trading volumes for March and Q1

Electronic bond market operators saw a new boost to volumes in March, and in the first quarter more broadly, as volatility in capital markets...

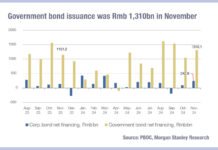

China government bond issuance reducing transparency of total social finance

Understanding state support for the economy in China can be measured across several dynamics, but debt provision to the non-financial private sector, known as...

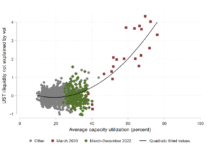

Picturing uncertainty in a traditionally stable market

Trading numbers in secondary corporate bond markets appear to reflect anecdotal reports of volatility bursts, as political false starts impact the reading of major...