Hargreaves Lansdown offers retail investors access to gilts in primary market

Hargreaves Lansdown is giving its clients access to Debt Management Office (DMO) Gilt auctions.

Tim Jacobs, head of primary markets, Hargreaves Lansdown, says, “This...

Aegon AM wins short-dated investment grade bond mandates

Aegon Asset Management’s reports it has won two UK clients totalling £325 million for its short-dated investment grade bond strategy, with a further mandate...

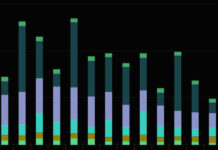

Review: Mixed bond trading revenues in choppy first quarter

Banks have seen mixed results from bond trading in the first quarter of 2023, across credit and rates, while electronic trading platforms have seen...

Are US dealers still offsetting credit trading risks?

As US banks see credit positions turn negative, and interdealer market volumes remain flat, The DESK asks how they offset risk as their credit...

Greenwich Associates: Buy side negative on CLOB for US treasuries

By Flora McFarlane.

Only 16% of buy-side firms thought using a central limit order book (CLOBs) would have a positive impact on trading US treasuries,...

Greenwich: Buy-side traders rate counterparties by data, not friendship

Relationships are becoming less important when buy-side traders are deciding which counterparties to trade with, as data on previous trading activity takes on a...

Citadel Securities’ new hires are reinforcing US credit market expansion

Citadel Securities has seen a spate of hirings on its credit trading teams in January 2024, supporting its expansion into the corporate bond space...

The implication of falling US HY Issuance

Anecdotally, we hear that new issuance of high yield bonds in European markets directly impacted secondary market liquidity. Looking at the latest data from...

S&P Global Ratings: European credit spreads still wide

In its latest ‘Europe Credit Markets Update’, S&P Global Ratings has painted a grim picture for European borrowers, notably in the high yield space,...

OpenDoor reveals greatest challenge and a turbo-charged match rate

OpenDoor has revealed a significantly high match rate for asset managers on the all-to-all continuous order book it launched in January 2020, to replace...