As US banks see credit positions turn negative, and interdealer market volumes remain flat, The DESK asks how they offset risk as their credit trading volumes rise with other counterparties.

The proportion of trading conducted electronically is growing in US fixed income markets, despite 2022’s markets reflecting activity that historically was handled over the phone, according to a new report published by analyst firm Coalition Greenwich, analysing bond trading in July.

“Over 40% of investment-grade activity was executed via electronic platforms for the fourth month in a row, with the year-to-date (YTD) average coming in at 39.5%,” wrote report author Kevin McPartland, head of research for market structure and technology at the firm. “High yield has been equally impressive, with a YTD average of 29.7%.”

This continued expansion of trading into the electronic sphere will in part reflect increased frustration amongst buy-side traders, who are clearly finding the lower levels of liquidity being provided by sell-side dealers hard to handle.

The market is a risk-off environment this year, as interest rate rises and macro-events rock valuations. For banks, this has enabled greater profitability in secondary markets but apparently at the cost of consistent liquidity provision to clients. There is less competition in portfolio trading amongst banks, according to multiple anecdotal reports, and the CEO of MarketAxess. However, conditions have overall been worse in Europe than in the US.

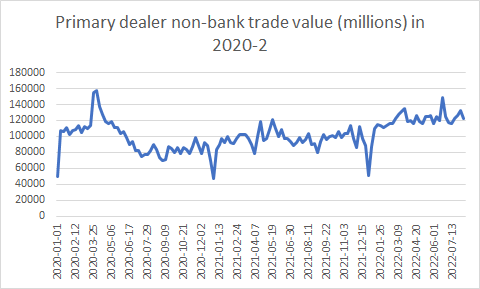

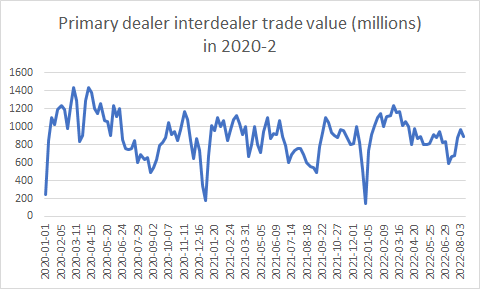

We can see a more quantitative analysis of bank activity in data supplied by the The Federal Reserve Bank of New York. It has reports from primary dealers, those sell-side trading counterparties of the New York Fed in its implementation of monetary policy, who are expected to make markets for Fed on behalf of its official accountholders as needed, and to bid on a pro-rata basis in all Treasury auctions at reasonably competitive prices.

Looking at corporate bond markets, we can see that primary dealer trading volumes with clients i.e. outside of the interdealer markets which they use to manage positions, has risen since 2020.

By contrast, trading between primary dealers and other banks on the interdealer has not increased, despite the apparently greater activity in secondary markets suggesting that banks may be finding different ways to offset the risk of trading in and out of positions.

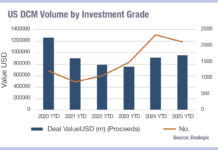

Overall, corporate bonds trading volumes in 2022 year-to-date across both investment grade and high yield are down slightly, 1.5%, against the same period in 2021, according to SIFMA data.

Dealer inventories are low to negative in US credit, notably so in high yield between 5-10 yrs debt and to some extent in that bracket for investment grade credit.

The question that needs answering, is how the largest banks are growing their non-dealer trading volumes without either increasing their positions or significantly increasing.

One answer may be the use of electronic trading via trading venues and with non-traditional buy-side counterparties in order to facilitate more agency style trading.

“Much of the [electronic trading] growth still comes from non-disclosed RFQ protocols,” noted McPartland. “Disclosed RFQ accounted for 38% of activity in July, the first time we’ve ever recorded a reading below 40%. Conversely, MarketAxess saw 36% of its volume executed through Open Trading for the second consecutive month, the highest level since December 2020. Tradeweb continued to see growth in both its portfolio trading and Dealer Sweeps protocols, while Trumid pointed to a record share of US corporate bond volume in July.”

The greatest effect that traders expect electronic trading to have reflects its efficiency and speed. Typically buy-side traders have turned to electronic trading to support smaller ticket sized trades, as their processing is less complex meaning that volume of trades is a greater problem than the size of the order.

It may well be that electronic trading is not proving invaluable to dealers as they strive to find gold in the dried up riverbeds of corporate bond markets.

©Markets Media Europe 2025