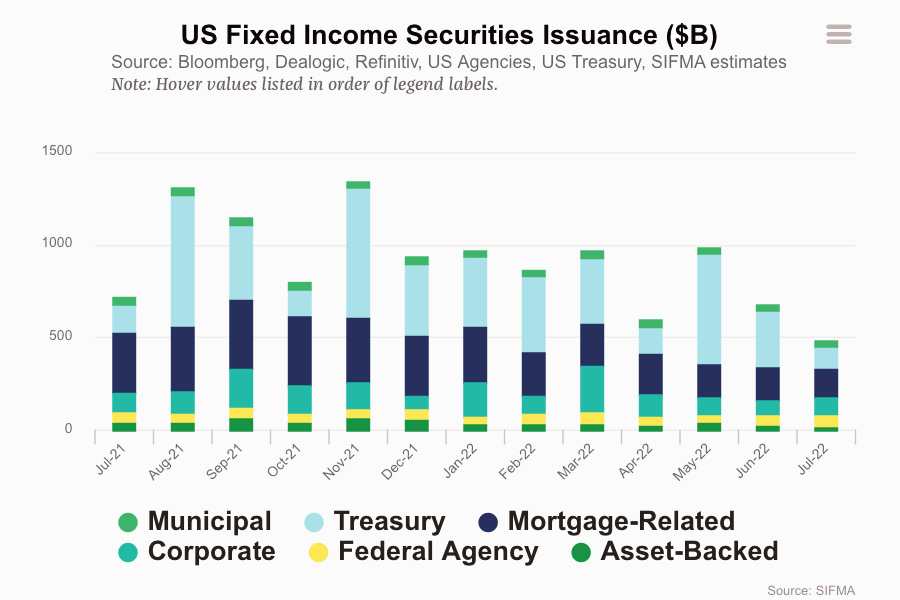

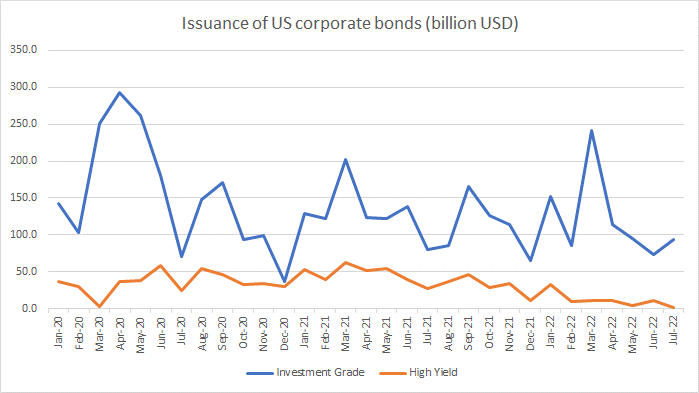

Anecdotally, we hear that new issuance of high yield bonds in European markets directly impacted secondary market liquidity. Looking at the latest data from SIFMA, as provided by Refinitiv, we see that issuance is now collapse in US HY markets as well. The question is whether traders need to be concerned that this may be a signal, pre-empting a liquidity drought in HY markets.

High yield assets, as a category, are more susceptible to liquidity droughts than investment grade bonds. The higher risk of defaults creates relatively lower investment appetite amongst institutional investors, despite the potentially greater returns.

In a rising rate environment, the costs of issuing debt are considerably higher for corporates in the HY bucket and that is reflected un the difference between issuance trends across HY and IG. Default rates are expected to be higher amongst the more at-risk HY firms, reducing investor appetite for more bonds in this risk rating.

Another recent trend had been the reduced appetite for longer dated bonds amongst investors, as the Federal Reserve began to signal, and then implement, interest rate hikes.

Consequently, looking at the drop off in new issuance, there is likely to be a point at which a lump of debt, both older long-dated and more recent short-dated, will need to be refinanced. That may well create a peak of demand for HY portfolios, and therefore a directional liquidity event. In our secondary markets article we assess current liquidity conditions.

©Markets Media Europe 2022

©Markets Media Europe 2025