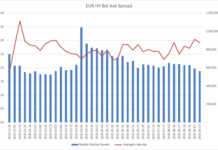

High yield market makers comfortable with risk

European bond traders are seeing average trade sizes expanding in September while bid ask spreads lower to the bottom end of their range as...

Credit is climbing, but unevenly

Analysis by S&P Global Market Intelligence charts the rise of credit markets over the past year, and finds index levels are by 10-15% of...

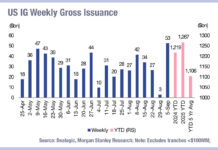

September explodes with new corporate bonds

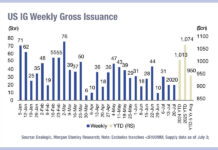

Traders report expectations of outsized corporate bond issuance, with up to US$60 billion expected in US investment grade issuance, and reached $53 billion last...

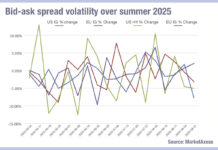

Price volatility in credit

We saw a big drop in average bid-ask spreads (>7%) for US investment grade (IG) last week, possibly a response to the massive levels...

What to do when credit goes quiet…

The low volumes in credit trading over summer created an opportunity for traders to engage in strategic projects that deliver longer-term benefits to the...

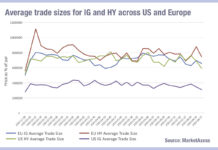

Analysing the split between US and EU investment grade trade sizes

Recent reports that high yield (HY) trades are increasing in size and investment grade (IG) are shrinking, have ignored the year-on-year growth of European...

Investor Demand: IG private credit creates ‘attractive entry points’ for investors

Research by Aviva Investors has broken down the illiquidity premia paid via private debt markets, noting that it is improving for investors, even as...

Get your trade dressed to kill (or execute)

Getting a trade to look attractive to a counterparty gets harder the more illiquid, large, and specific it is. As the purpose of a...

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

Year-to-date issuance higher in corporate bonds as leveraged loans drop

Issuance of corporate debt in the US and European markets is looking relatively strong year to date, however loans have tailed off significantly, according...