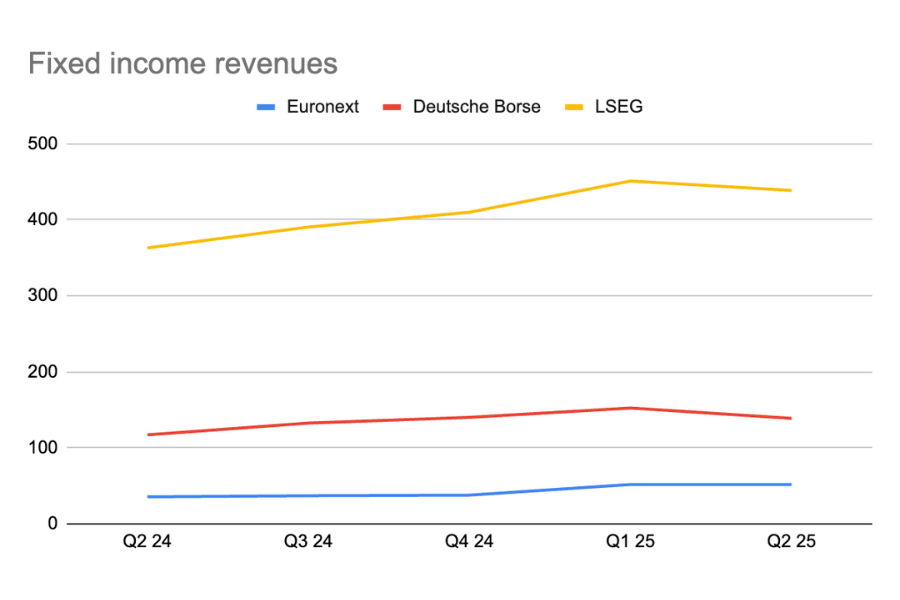

Fixed income trading revenues dipped in the second quarter at European exchanges – but were up more than 20% across the board.

LSEG’s fixed income revenues were once again heavily augmented by results at Tradeweb, in which it owns a 50.8% stake.

The group reported €438.6 million in fixed income, derivatives and other revenues within its capital markets business, representing a 20.8% year-on-year (YoY) increase and a 2.7% quarter on quarter (QoQ) decline.

In the firm’s results call, chief financial officer Michel-Alain Proch stated, “Tradeweb is continuing to successfully execute on their strategy, while benefiting from favorable market conditions across all their asset classes. The integration of Institutional Cash Distributors (ICD) [August 2024] is doing well.”

LSEG paid Tradeweb US$20.6 thousand in market data fees in Q2 2025.

At Deutsche Borse, fixed income trading and clearing revenues were down 8.9% QoQ and up 20.8% YoY to €138.8 million. Despite the dip, during the company’s earnings call, chief financial officer Gregor Pottmeyer reinstated the firm’s expectations of achieving a €300 million+ fixed income business by 2026.

He noted, “So far, we have onboarded 600 clients in H1. We have 2,100 clients on the fund level – but only 350 are active. This will change in the next six to 12 months due to the active account requirements [under EMIR 3]. We are confident that we will get a tailwind out of that.”

He stated, “In the €STR, we have roughly a 50% market share. In Eurobor, we have a 6-7% market share.”

“We are confident that we are very well positioned, and that is one of the key arguments to realise at the end of the day that Eurex is the home of the euro from the short term to the long-term.”

Euronext moved from reporting fixed income trading and overall clearing revenues separately to combining fixed income trading from its MTS business, and clearing revenues in 2025. This resulted in a reported €51.7 million in revenues for Q2 2025, down 0.1% QoQ.

On a combined basis, CEO Stéphane Boujnah stated during the Euronext earnings call that fixed income trading and clearing revenue grew by 31.9% YoY.

He noted, “This was driven by the continued favourable market condition, wider adoption of algorithmic trading and the supportive debt management policies.”

Euronext has made various attempts on Deutsche Boerse’s dominance in the European fixed income derivatives market, announcing a September launch for government bond mini-futures earlier this year.

READ MORE: “Way more flexibility than at Eurex”: Euronext announces govie mini-futures

When questioned on the role of Euronext’s MTS in French OAT issuance, Boujnah said, “There is a growing interest for what can be done to improve the liquidity of the French sovereign debt, but nothing material has happened.

“It is a very structural change for any debt management office to move from a pure primary dealer relationship towards a combined situation where you have both primary dealers and electronic platforms like MTS.

“Dialogues are very intense at all levels of the French Ministry of Finance from elected officials to leading officials in the organization and the bureaucrats. It’s a work in progress.”

©Markets Media Europe 2025