A burst of spread widening and credit ETF related trading pushed US electronic credit trading to another record in April.

TRACE volumes for investment grade (IG) and high yield (HY) corporates reached US$62 billion in average daily volume (ADV), according to Tradeweb, up 27 per cent year on y ear (YoY). IG slipped 2.2% from March to US$46.4 billion, but HY leapt 13.3 per cent to a series high US$15.7 billion as credit volatility and bid/ask spreads surged. MarketAxess reported slightly different numbers but an overall concurring pattern for TRACE activity.

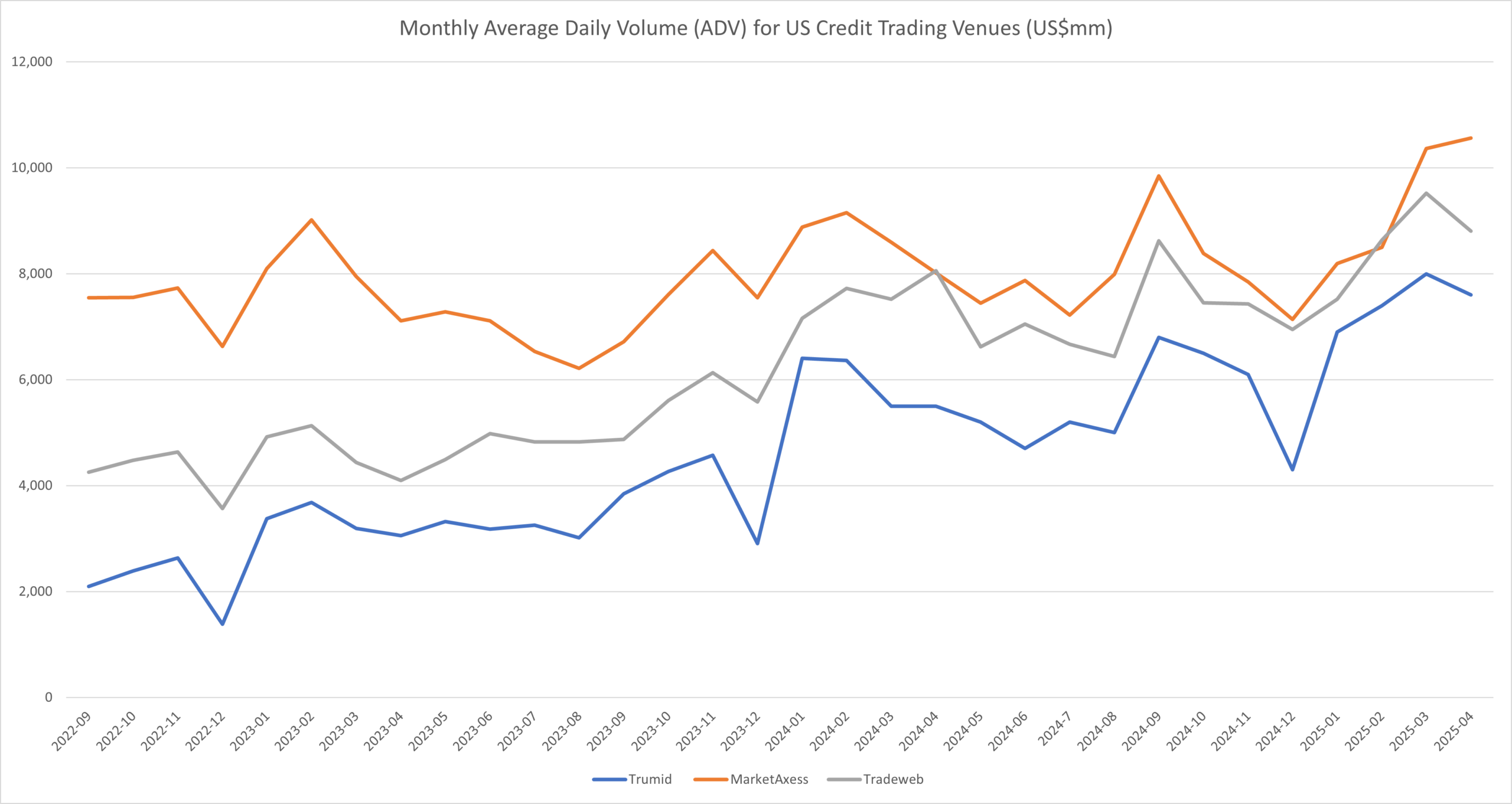

MarketAxess reported record total credit ADV of US$18.4 billion, 32 per cent above April 2024 and 3 per cent ahead of March 2025. US high grade ADV was US$8.6 billion (+30 % YoY), second only to March’s peak, while HY hit US$2.0 billion, the highest since February 2023 and 38 per cent up YoY. Emerging markets (US$4.3 billion, +27 % YoY), Eurobonds (US$2.8 billion, +37 %), municipals (US$0.74 billion, +66 %) and “other” credit all set new monthly records. Open Trading accounted for 38 per cent of total credit flow and portfolio trading ADV doubled YoY to US$1.8 billion.

Citi Research estimates from 29 April put MarketAxess’ market share at 19.5 21.5 % in IG and 13 15 % in HY, both higher than March and ahead of Tradeweb.

Tradeweb’s fully electronic US credit ADV climbed to US$8.8 billion, up 9 per cent YoY and just 1 per cent shy of March’s record. HY trading was the standout, with a record US$1.28 billion ADV, helping lift its fully electronic HY share to 8.4 %. Municipal bond ADV surged 58 per cent YoY to an all time high of US$550 million, while credit derivative ADV doubled YoY to US$29.6 billion. Tradeweb estimated its total US IG share at 18.8%for April.

Beyond electronic credit, Tradeweb booked fresh records in US government bonds (US$290 billion ADV, +42 % YoY) and global repo (US$767 billion, +28 % YoY).

Private venue Trumid logged US$7.6 billion in April ADV, 39 per cent higher than a year earlier and only modestly below its March record. The firm does not disaggregate volumes by product, making direct comparison more difficult, yet it said RFQ and portfolio trading (PT) both set fresh highs, with PT ADV up 55 per cent month on month and more than double YoY. Trumid also highlighted RFQ “no touch” automation gains and the launch of AI driven workflow tools in its monthly update.

©Markets Media Europe 2025