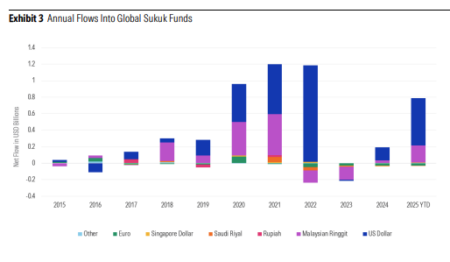

According to Morningstar, at the end of 2024, the global sukuk markets, which represents Islamic securities structured to replicate conventional bonds, reached US$930 billion in notional outstanding, marking a growth of 7.7% from US$863 billion the previous year. Despite this expansion, sukuk-dedicated funds AUM remain low, totalling just US$5.8 billion in assets as of May 2025, up from US$5 billion a year earlier.

Shannon Kirwin, principal for fixed Income ratings at Morningstar, noted the increasing relevance of sukuk but also highlighted inherent limitations.

“The market’s concentration in specific geographies and heavy exposure to a few issuers makes it less suitable as a long-term core allocation compared to more diversified conventional bond strategies,” she said. “However, for investors restricted to Shariah-compliant vehicles, the range of both active and passive sukuk funds is widening.”

A notable development in recent years has been the emergence of passive exchange-traded funds (ETFs), which have broadened investor access to the sukuk market. Yet, Morningstar’s analysis revealed that passive sukuk ETFs remain relatively expensive, with management fees ranging between 0.35% to 0.50%, notably higher than comparable conventional bond ETFs. For example, Vanguard USD Emerging Markets Government Bond UCITS ETF is reducing its fee to 0.23% from 1 July 2025.

Furthermore, actively managed sukuk funds carry even higher average fees of approximately 1.34%, reflecting the costs associated with managing portfolios that often include riskier, below-investment-grade issuers.

The report outlines specific characteristics of sukuk that differentiate them from conventional bonds. The sukuk market, dominated largely by Islamic banks, has historically benefited from lower volatility due to its buy-and-hold investor base. This stability has often provided sukuk investors with a buffer against short-term market fluctuations. Morningstar notes for example during the interest rate shock between January and March 2021, the Dow Jones Sukuk Total Return Index lost only 1.04% compared to Morningstar EM bond Index losing 3.33%, and 4.34% compared to Morningstar US treasury bond Index.

However, Kirwin warned, “This feature could diminish if funds become a more meaningful portion of the market—and it should not be mistaken for a lack of credit risk.” Indeed, recent geopolitical tensions in the Middle East have caused short-term volatility, underscoring inherent risks within sukuk portfolios, although many managers remain confident in the underlying credit fundamentals of the region.

Another challenge identified by Morningstar relates to the concentrated geographic profile of the sukuk market. Gulf countries dominate hard-currency sukuk issuance, while Malaysia leads in local-currency issuance, significantly limiting geographical diversification. While the United Arab Emirates (UAE), and Saudi Arabia represent 37% of hard currency issuance and Malaysia only 6%, in local currency issuance Malaysia share of issuance is 60%. This concentration could pose substantial risks for investors using sukuk as a core allocation.

Morningstar also highlighted the ongoing discussions within standard-setting bodies, notably the Bahrain-based Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI). The forthcoming AAOIFI Standard 62 proposes stricter treatment for asset-based sukuk, potentially affecting market dynamics. Despite initial concerns, fund managers and industry experts consulted by Morningstar expressed optimism that AAOIFI would ultimately prioritise market stability.

Morningstar’s report concludes that as the market grows, Sukuk funds and investments appeal increases for Shariah aligned investors, but the limited diversification and concentration risks inherent to the market make them less suitable as a core holding compared to more globally

©Markets Media Europe 2025