Tag: Citi

Swami takes on Singapore markets

Citi has promoted Nathan Swami to head of markets for Singapore, which Citi says is one of its key trading hubs in the APAC...

Trading protocol gains bolster liquidity sourcing

Perspectives vary as to which newer methods of buying and selling bonds will most help institutional traders in the next year, but there is...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Tharshan joins Citi credit trading team

Tharsh Tharshan has joined Citi as a credit trader. He is based in London.

Citi reported revenues of US$81.1 billion in 2024, up 3% from...

Citi’s Peneety swaps to Citadel Securities

Citi veteran Vincent Peneety has jumped ship to Citadel Securities.

Based in New York, Peneety has joined the investment grade credit sales team at the...

Chan to take on Asia market sales at Citi

Citi Markets has named Christopher Chan as head of market solutions for Asia North and Asia South financial institutions, effective July.

Citi reported US$19.8 billion...

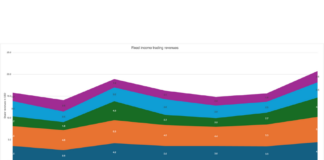

JP Morgan leads Q1 trading results, Dimon calls for deregulation

JP Morgan raced ahead of competitors in fixed income trading revenues over the first three months of 2025, reporting over US$1 billion more than...

Tradeweb launches EGB portfolio trading

Tradeweb has expanded its portfolio trading services to European Government Bonds (EGBs).

Tradeweb has facilitated electronic portfolio trading for corporate bonds since 2019. Responding to...

Insights & Analysis: Pricing freedom

The street is waiting anxiously for the announcement and impact of all the trade tariffs to be announced on 'Liberation Day’; the term the...

The Book: JP Morgan rules the roost in Q1 DCM market...

JP Morgan has retained its top spot in global debt capital markets rankings by volume for Q1 2025, according to Dealogic.

With US$178.5 billion, 806...