Tag: Coalition Greenwich

‘Equitisation’ of bond market on its way

Bond markets are following the same pattern as equity markets did in the 1990s, according to Coalition Greenwich’s Kevin McPartland, becoming more electronic trading-driven.

The...

September: US corporate bond ADNV hits $54bn, up 46% YoY

The average daily notional volume (ADNV) for US corporate bonds hit a new high of US$54 billion in September 2024, a 46% increase compared...

September: US rates ADNV up 35% YoY amid wider uncertainty

In September, overall trading in US rates rose 1% year-over-year, standing at 59% of volumes, while the average daily notional volume stood at US$988...

European credit trading is treading its own path

Understanding the unique features of European capital markets is hugely important for traders and infrastructure providers, but so are the differences this makes to...

August: US Treasuries record first trillion-dollar ADNV

US Treasuries had their first trillion-dollar month in August thanks to a surprise rate hike from the Bank of Japan and ongoing fiscal uncertainty...

Subscriber

Mandatory central clearing: More resilient treasury market expected

Mandatory central clearing is expected to make the market safer and more resilient. But there is a catch. The new regulations – set to...

Smaller proportion of US Treasuries e-traded than previously estimated

Levels of e-trading in US treasuries in dealer-to-dealer (D2D) and dealer-to-client (D2C) markets have come into sharper focus thanks to data collected by FINRA...

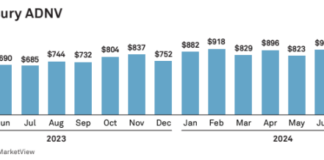

US corporate bond market growth continues upward trend in July

The US corporate bond market in July saw increases across nearly all the metrics tracked by Coalition Greenwich, with average daily notional volume (ADNV)...

IRD traders see room for improvement in dealer technology use

Close to a third of interest-rate derivatives (IRD) traders are content with the technology use of their dealers, according to a recent Coalition Greenwich...

E-trading on the rise in Japanese bonds

Japan’s initially slow adoption of e-trading is increasing in pace as local investors seek liquidity in local and foreign markets, according to a recent...