Tag: HSBC

Fenwick joins HSBC

David Fenwick has joined HSBC as an investment grade credit sales trader, swapping the buy side for the sell side.

HSBC reported US$6.7 billion in...

Banks buy into LSEG’s Post Trade Solutions

Banks using LSEG’s post-trade solutions have taken a 20% stake in the business, paying £170 million for the shares.

The transaction is expected to close...

Societe Generale hires Anu Iyanda

Societe Generale has appointed Anu Iyanda as an emerging markets credit trader in London.

Iyanda joins from HSBC, where he spent over three years trading...

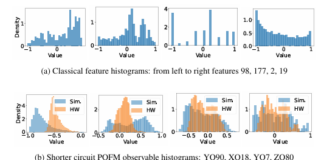

Quantum computing ‘breakthrough’ has “more red flags than a People’s Liberation Army...

The claim by HSBC that noise in an IBM quantum computer helped deliver a 34% improvement in algorithmic trading performance has been disputed by...

Quantum leap: HSBC, IBM improve bond RFQ fill rate by 34%

HSBC and IBM have reported a 34% improvement in fill-rate modelling for bond request-for-quote (RFQ) using quantum-generated features and common data science algorithms.

The bank–technology...

McGeogh swaps HSBC for Deutsche Bank

Lisa McGeogh has left HSBC after eight months after being named US chief executive at the firm, joining Deutsche Bank as head of the...

Guignot leads BNP credit e-trading in Europe

Alexandre Guignot has joined BNP Paribas CIB as head of credit e-trading in Europe.

BNP Paribas reported strong second quarter revenues in fixed income trading...

BNP Paribas sees yearly boost in FI trading revenues

BNP Paribas was the success story in Q2 2025 fixed income trading, reporting €1.4 billion in revenues. Despite reporting a 16% decline in revenues...

Kapoor swaps BBVA for HSBC

Sonu Kapoor has joined HSBC as an emerging markets trader, based in New York.

HSBC’s corporate and institutional banking arm reported US$7.1 billion in revenues...

Barclays bounces with strong Q1 trading revenues

Fixed income trading revenues spiked in the first three months of the year at Barclays, putting the bank significantly ahead of the majority with...