Tag: Kevin McPartland

E-trading flat as US credit volumes balloon

Electronic trading in US credit showed little movement between 2024 and 2025, hovering just below 50% of investment grade (IG) volumes and remaining at...

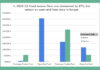

US credit volumes jump YoY

US corporate bond trading is expecting to reach record levels in 2025, according to a recent Coalition Greenwich report.

In November, average daily trade sizes...

US rates e-trading stabilises

Electronic trading in US rates dropped by five percentage points year-on-year (YoY) but rose by two percentage points month-on-month (MoM), representing 57% of total...

US retail goes big on directly-held bonds

Retail investors are leaning back into bonds, according to a recent Coalition Greenwich report – and are increasingly owning them directly, rather than through...

Volumes up, e-trading down in US rates

Average daily notional volumes in US rates jumped 11 percentage points year-on-year (YoY) in October, reaching US$989 billion. Volatility was down by 40%, with...

Coalition Greenwich: “E-trading in HY is only just getting started”

Average daily notional volumes were up 4% year-on-year (YoY) to US$51 billion in US credit this October, with average daily trade sizes rising by...

US credit issuance hit record highs in September

US credit issuance was at its highest level since May 2020 at the start of September, pushing average daily notional volumes up 4% year-on-year...

US rates volatility, e-trading decline in September

E-trading was down five percentage points year-on-year (YoY) and one percentage point month-on-month (MoM) in US rates over September, taking 54% of overall volumes.

Dealer-to-client...

Soft volatility hinders US rates e-trading

Volatility was down 27% year-on-year (YoY) and down 6% month-on-month (MoM), with the MOVE index recording 80.43. This is the index’s lowest level since...

Half of US IG credit e-traded in July

Electronic trading levels in US investment grade credit hit the halfway mark in July, up one percentage point year-on-year to take 50% of notional...