Tag: MarketAxess

E-trading platforms show mixed results in October’s market share battle

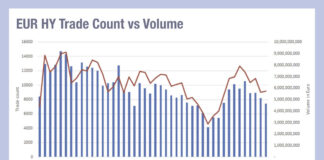

Electronic trading fixed income platforms saw a slight drop off in volume relative to October, but strong activity against the same period last year.

Bond...

The election effect: Secondary markets

While the effect of an election on the markets is typically subdued on the day itself – more so when the outcome is uncertain...

How is e-trading accelerating the momentum for global Emerging Markets?

Despite persistent macroeconomic challenges, EM bonds have achieved broad gains in 2024.

Traders are increasingly on the lookout for tools that can help them...

MarketAxess and S&P Global Market Intelligence partner on FI data

S&P Global Market Intelligence and MarketAxess have begun a fixed income data partnership, aiming to improve market transparency and efficiency. Integration between the two...

Under pressure

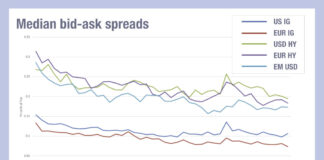

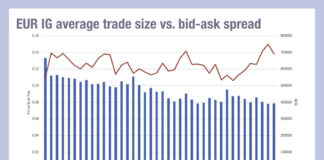

Secondary markets trading has seen a net trend towards tighter bid-ask spreads for trading across all corporate bond segments in US, Europe and emerging...

Dealers face crunch on platform trading costs

As bid-ask spreads tighten and fees rise, dealers question making markets in credit.

It does not take a quant to understand that tighter bid-ask spreads...

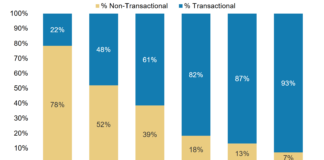

Is European credit electronification bouncing back?

There has been a noted proportional increase in electronification of US credit trading, as tracked by Coalition Greenwich. However, metrics around European trading found...

September ADV: E-trading platforms see volumes soar

Fixed income platforms saw their average daily volume (ADV) in September reach record highs with MarketAxess witnessing a 52% increase compared to September last...

FILS 2024: Applying AI to trading

Asset management and trading businesses are being transformed by artificial intelligence. That was the message from a series of panels at the Fixed Income...

Enhanced execution through automation

Andrew Cameron, Automation Solutions at MarketAxess, discusses the benefits of automation in trading.

Automation technologies have revolutionised so many aspects of our lives that it’s...