Tag: MarketAxess

MarketAxess sees big increases in Eurobonds and emerging markets ADV in...

MarketAxess, electronic trading platform for fixed-income securities, has seen its total credit average daily volume for August 2023 inch up by 2% YoY, while...

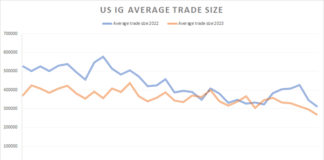

Are average trade sizes really falling in the US?

Earlier this year we noted that average trade sizes were down considerably on 2022, but being wary of mean reversion, we wanted to revisit...

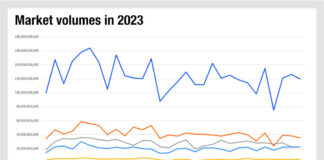

Seize the opportunity to apply AI in quieter bond markets

Secondary credit trading is seeing lower volumes as expected in the summer months, whilst bid-ask spreads have plateaued across Europe and the US markets,...

Local currency emerging market trading grows at MarketAxess

MarketAxess, the operator of an electronic trading platform for fixed-income securities, has seen a rise in volumes of local currency bond trading in emerging...

MarketAxess to buy algo provider Pragma

Bond market operator, MarketAxess, has entered into a definitive agreement to acquire Pragma, a quantitative trading technology provider specialising in algorithmic and analytical services...

July 2023: MarketAxess sees mixed bond ADV results

MarketAxess sees mixed bond ADV results in July 2023, credit ADV up 8% YoY

MarketAxess has reported total credit average daily volume (ADV) of US$11.4...

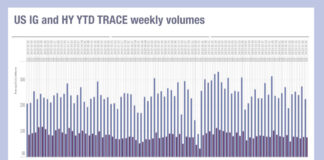

The summer lull barely touches emerging markets

Trading volumes in fixed income markets typically start the year high and gradually fall, matching issuance and refinancing patterns along with investment allocation decisions....

LatAm sees e-trading momentum with support for all-to-all

In Latin America, 46% of trading in corporate hard currency bonds is conducted electronically, according to research by analyst firm Coalition Greenwich, compared to...

Exclusive: What do buy-side traders think about Citadel’s entry into credit?

We asked senior buy-side trading heads about electronic market maker, Citadel Securities, entry into the corporate bond market as a direct market maker, a...

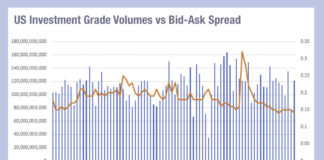

Implied cost of liquidity falling, with US high yield an exception

Volumes in the corporate bond markets have been picking back up, relative to bid-ask spreads, indicating an improving liquidity picture across the US and...