Tag: MarketAxess

MarketAxess launches FI opening and closing auctions

MarketAxess is launching opening and closing auctions for US credit “in the coming weeks”.

Opening and closing auctions have long been available in equity and...

Trade size disparity in US credit speaks volumes about balance sheet

Analysis of trading activity in the US corporate bond market shows that investment grade (IG) bonds are seeing greater moves towards larger order sizes...

The Bondcast: Dealing with Blocks

This is the Bondcast interview with Chris Egan of MarketAxess, to discuss the barriers to engagement in block trading today for dealers, and how...

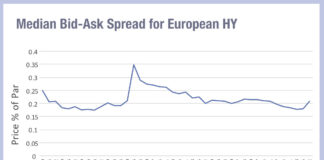

Bid-ask spreads expanding in European credit

European credit traders have seen bid-ask spreads expand over the past two weeks, however this follows a notable tightening since summer, according to data...

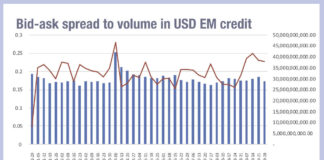

The rapid rise – and risks – of EM e-trading for...

Dealers are competing fiercely to support clients in emerging market bonds, jumping between optimal electronic execution methods and developing nascent trading algorithms themselves where...

Fund managers report more certainty in EM than in developed markets

The key takeaway from the first plenary session at the Fixed Income Leaders Summit in Amsterdam was clear; in 2026, uncertainty has become a...

FILS EU 2025: Traders need to take control of their future

While the European and UK consolidated tape fiascos are dominating gossip around the Fixed income Leaders Summit in Amsterdam, other big themes are clearly...

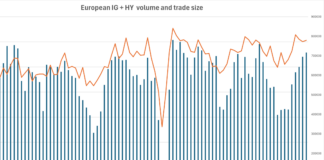

European credit trades size up 15% year on year Q3

European credit trades keep getting larger. The notional blended trade size for Investment grade and high yield European credit was €786k in September 2025...

Trumid’s US electronic credit volume in sight of MarketAxess’ and Tradeweb’s

US electronic credit activity accelerated in September as primary-market heavy issuance spilled into secondary trading. On FINRA’s TRACE tape, combined US investment-grade and high-yield...

What’s up EM?

Emerging market volumes have jumped in September, hitting levels not seen since April 2025, when the US trade taxes on imported goods from every...