Tag: MarketAxess

MarketAxess reclaims electronic credit trading crown in quiet market

US electronic credit activity eased sharply in August. On FINRA’s TRACE tape, combined US investment-grade (IG) and high-yield (HY) average daily volume (ADV) came...

Credit futures see OI and ADV increase more than sevenfold YoY

The adoption of credit futures as a mainstream credit trading vehicle is broadening across venues and currencies: US$ iBoxx total return based futures traded...

Investor demand: French no-confidence vote sharpens pressure on OAT-Bund spread

French Prime Minister François Bayrou’s call for a no confidence vote was scheduled for the 8 September late on Monday 25 August. Aiming to...

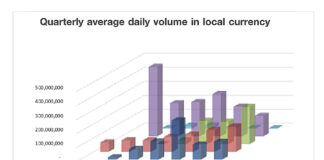

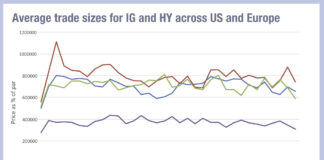

Analysing the split between US and EU investment grade trade sizes

Recent reports that high yield (HY) trades are increasing in size and investment grade (IG) are shrinking, have ignored the year-on-year growth of European...

Portfolio Trading and price discovery in US IG and HY markets

By Jessica Hung and Chisom Amalunweze

In our PT vs RFQ List White Paper, we found that PT provides superior execution outcomes for illiquid bonds,...

What Mexico’s vol risk means for trading LatAm bonds

In Latin American (LatAm) markets, economic volatility may transfer into market volatility – most notably in Mexico.

In order to manage risk and seize opportunities...

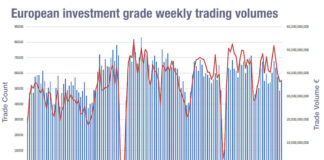

Summer heat subdues European activity

Activity in both European high yield (HY) and investment grade (IG) declined in the last week of July, with trade volumes falling to yearly...

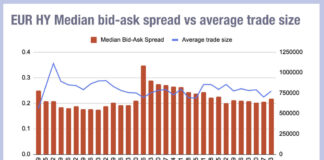

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

US electronic platforms’ credit activity plateaued in July

Tradeweb now narrowly leads over MarketAxess in fully electronic US IG+HY trading, Trumid said it continues to gain market share.

Average daily volume reported on...

MarketAxess brings mid-point matching protocol to US credit

MarketAxess has launched its anonymous mid-point matching session protocol, Mid-X, in US credit.

Mid-X uses CP+, MarketAxess’s real-time predictive pricing engine for its global credit...