Tag: MarketAxess

Buckley swaps MarketAxess for JP Morgan

Mark Buckley has joined JP Morgan as vice president of e-credit sales, based in London.

JP Morgan reported US$5.7 billion in fixed income trading revenues...

EM traders ride out the chaos

It would be understandable if trading in emerging markets (EM) debt were becoming more expensive as risk increased in many markets it makes up,...

US electronic platforms’ credit activity cools further in

Average daily volume reported on TRACE for US investment grade (IG) and high yield (HY) dropped a further 9% month-on-month (MoM) in June to...

The Bondcast: Simplifying Hard Currency EM Bond Trading

Hard currency EM bond trading is characterised by fragmented markets, multiple time zones, noisy data and growing trade volumes. Traders need timely insights on...

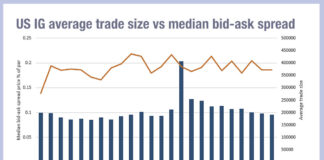

Do Europe’s credit trading costs invert the pattern for US debt...

An analysis of average bid-ask spreads in corporate bond markets across the European and US markets suggests that median bid ask spreads responses are...

Optimising execution in Qatari and Kuwaiti bond sell-off

Buy-side traders need to carefully manage order execution when a bond market moves into or out of an index, as the large directional moves...

MarketAxess brings e-trading to Indian govies

MarketAxess has become the first firm to offer electronic trading in India with the launch of an Indian Government Bond (IGB) trading solution for...

Electronification of US credit delivers resilience

The electronification of the US corporate bond markets has demonstrated that its improved efficiency has strengthened depth of liquidity provision, rather than made it...

S&P Global Market Intelligence: MarketAxess collaboration to enhance fixed income market...

Following the announcement of a new data partnership between S&P Global Market Intelligence and MarketAxess, Traders Magazine* sat down with Kat Sweeney, Head of...

US electronic credit trading slows down in May

Average daily TRACE volume for US investment grade (IG) and high yield (HY) corporates slipped 10.8% from April to US$52.8 billion, according to MarketAxess...